[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,870 | -40.50 |

| Oil (WTI) | 86.20 | 1.16 |

| 10 year government bond yield | 3.48% | |

| 30 year fixed rate mortgage | 6.17% |

Stocks are lower this morning after economic bellwether FedEx withdrew its guidance based on a deteriorating economy. Bonds and MBS are down.

FedEx stock is down some 23% this morning after it issued a profit warning. Note that Fed Ex is on a May fiscal year. “Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first quarter results are below our expectations,” said Raj Subramaniam, FedEx Corporation president and chief executive officer. “While this performance is disappointing, we are aggressively accelerating cost reduction efforts and evaluating additional measures to enhance productivity, reduce variable costs, and implement structural cost-reduction initiatives. These efforts are aligned with the strategy we outlined in June, and I remain confident in achieving our fiscal year 2025 financial targets.”

It looks like the rate increases are beginning to be felt, and we will be seeing more of this. FedEx is kind of an economic canary in the coal mine. It looks like the Fed’s rate hikes are gaining some traction.

Consumer sentiment improved in September, according to the University of Michigan Consumer Sentiment Survey. Most notably, the median expected inflation rate declined to 4.6%, the lowest reading in a year. The Fed pays close attention to this number because inflationary expectations are a critical input into inflation. Inflation uncertainty is the highest it has been since 1982 however, which is a concern.

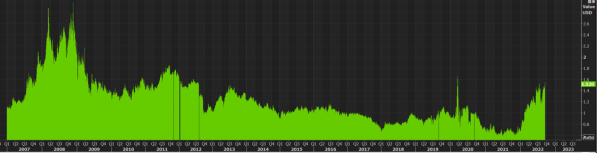

The rise in interest rates this year has caused MBS spreads to widen considerably. MBS spreads describe the difference between the mortgage rate and a Treasury of similar maturity. When MBS spreads are large (aka “wide” in trader parlance) it means that mortgage rates are high relative to underlying interest rates. This describes the current state of affairs, as MBS spreads have widened considerably this year. We are at 10 year highs (setting aside the short spike in the initial days of COVID).

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.