[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,034 | 28.75 |

| Oil (WTI) | 86.24 | 2.69 |

| 10 year government bond yield | 3.26% | |

| 30 year fixed rate mortgage | 5.94% |

Stocks are higher this morning on no real news. Bonds and MBS are up small.

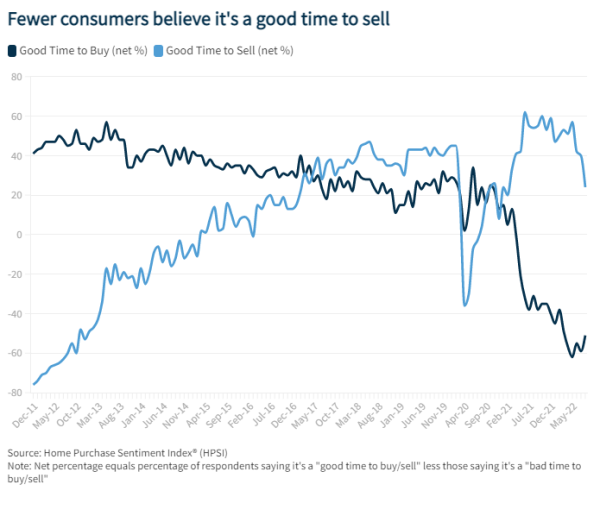

The Fannie Mae Home Purchase Sentiment Index fell in August as rising home prices and mortgage rates combined to make buyers reluctant to purchase. “The share of consumers expecting home prices to go down over the next year increased substantially in August. Accompanying this, HPSI respondents reported a significant decrease in home-selling sentiment,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “We also observed a large decline in consumers reporting high home prices as the primary reason for it being a good time to sell a home, suggesting that expectations of slowing or declining home prices have begun to negatively affect selling sentiment. Conversely, lower home prices would obviously be welcome news for potential first-time homebuyers, who are likely feeling the combined affordability constraints of the high home price and high mortgage rate environment. In fact, the survey’s ‘ease of getting a mortgage’ component dropped to an all-time low among this typically younger demographic (i.e., 18- to 34-year-olds). With home prices expected to moderate over the forecast horizon and economic uncertainty heightened, both homebuyers and home-sellers may be incentivized to remain on the sidelines – homebuyers anticipating home price declines and potential home-sellers not keen to give up their lower, fixed mortgage rate – contributing to a further cooling in home sales through the end of the year.”

Foreclosure starts are back at pre-pandemic levels, according to data from ATTOM. Foreclosure starts hit 34,501, which was up 118% compared to a year ago. Lenders started the process on 23,592 properties which was up 187% YOY. “Two years after the onset of the COVID-19 pandemic, and after massive government intervention and mortgage industry efforts to prevent defaults, foreclosure starts have almost returned to 2019 levels,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “August foreclosure starts were at 86 percent of the number of foreclosure starts in August 2019, but it’s important to remember that even then, foreclosure activity was relatively low compared to historical averages.”

In September, the Fed is upping the number of mortgage backed securities it will allow to run off, from $17.5 billion to $35 billion. This should (at least in theory) reduce the demand from the Fed and theoretically cause mortgage backed security spreads to widen. However, because prepayment speeds are slowing at a rapid clip it looks like the Fed won’t even get to $35 billion in maturing MBS. In other words, the Fed won’t be re-investing any maturing principal, and the runoff will be slower than permitted (since the Fed can’t control who pays their mortgage off).

It will be more important to watch what happens in Treasury re-investments. The last time the Fed tried to reduce its Treasury holdings, repo rates spiked, which forced them to suspend roll-offs. We’ll see if they have fixed the issue this time around.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.