[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,027 | -32.27 |

| Oil (WTI) | 94.42 | 1.38 |

| 10 year government bond yield | 3.09% | |

| 30 year fixed rate mortgage | 5.70% |

Stocks are lower this morning on follow-through Jerome Powell’s Jackson Hole speech last Friday. Bonds and MBS are down.

Jerome Powell’s Jackson Hole speech was a seismic event in the stock market, although the reaction didn’t really get going until long after. Here were his prepared remarks. It looks like this section was what got everyone’s attention:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

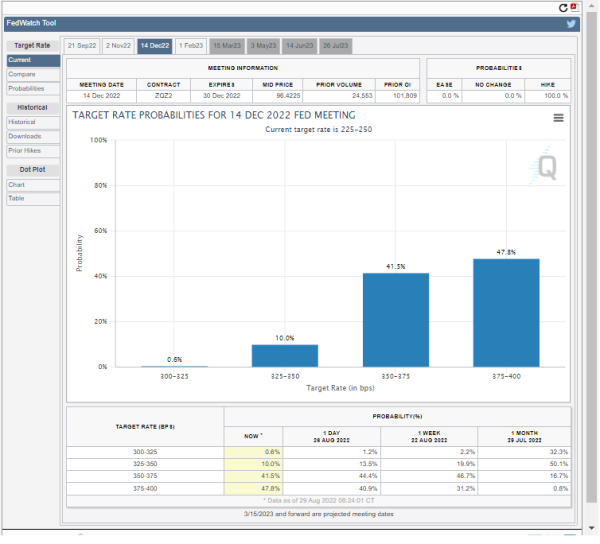

The stock market and the bond market sold off and the Fed Funds futures got more hawkish. They are now predicting a 2/3 chance of a 75 basis point hike in September and a 1/3 chance of a 50 basis point hike. The December futures are handicapping a 50% chance that the target rate will be 3.75% – 4.00%. A month ago, that wasn’t even in the mix. So basically over the past month, we have added about 50 basis points to the end-of-the year Fed funds futures forecast.

The reaction in the bond market was to send the 2 year and the 10 year yield higher, and a stronger inversion to the yield curve. The 2s 10s spread is 33 basis points and 2s 30s is 18 basis points. So this is a pretty substantial recessionary indication.

I would summarize the market’s interpretation of Powell’s comments as this: “We are going to raise rates higher than the market is anticipating, and will keep them there longer than the market is anticipating. We are going to cause a recession and if we have a hard landing, so be it.”

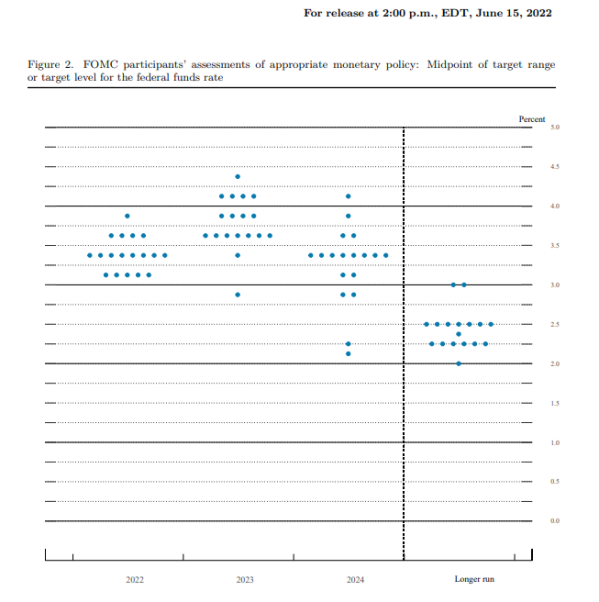

Is this an overreaction? Quite possibly. I would ask however if inflation has gotten worse or better since the June meeting. Because in June, the Fed saw a Fed Funds rate of 3.25% – 3.5%.

The month-over-month changes for the CPI were 1.0% in May, 1.3% in June and 0% in July. PCE inflation has been trending down as well. We will get 2 more jobs reports and 1 more CPI report before the Fed meets in September. If inflation is indeed moderating, I don’t see the Fed upping their own Fed Funds forecast, especially since they see the long-term rate (last column) around 2.5%.

The week ahead will contain a lot of important data, with the jobs report on Friday being the most critical. We will also get some house price data with FHFA on Tuesday. On Thursday we get ISM, productivity and costs and construction spending.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.