[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,046 | -80.5 |

| Oil (WTI) | 87.08 | -0.66 |

| 10 year government bond yield | 3.43% | |

| 30 year fixed rate mortgage | 5.97% |

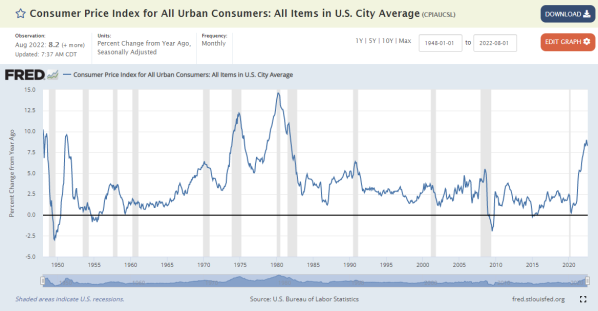

Stocks are lower this morning after the consumer price index (a measure of inflation) came in higher than expected. Bonds and MBS are down.

The consumer price index rose 0.1% in August, which was higher than expected. The Street was looking for 0.1% decrease as energy prices have been falling. On a year-over-year basis, prices rose 8.3%.

If you strip out food and energy, prices rose 0.6% MOM and 6.3% YOY. These were both higher than expected. Energy prices fell 5% MOM while food increased 0.8%. Higher prices for motor vehicles put upward pressure on the index.

The reaction in the markets was swift and severe. The S&P 500 futures went from a 0.75% increase for the day to a 2% decrease. In the bond market, the reaction was even more dramatic with the 10 year yield rising from 3.29% to 3.45%. The two-year spiked from 3.51% to 3.75%.

The Fed Funds futures were already predicting a 75 basis point increase at next week’s Fed meeting, and are now pricing in a 18% chance of a 100 basis point hike. The November futures are now pricing in a 75 basis point hike as well. The December futures now see a better-than-70% chance for a 4 handle on the Fed funds rate at the end of the year.

Needless to say, this report is highly bearish and raises the chance of a hard landing in the US economy. We are conceivably talking about 400 basis points in hikes over the course of 9 months, which is comparable to the rate hikes in the early 1980s in terms of magnitude.

Given that we started the year with negative GDP growth, and we haven’t begun to feel the effects of the summer rate hikes, I think a recession is inevitable, though the NBER will pull out all the stops trying to prevent itself from declaring one.

Notwithstanding the CPI print, the National Federation of Independent Businesses sees inflation beginning to moderate. The NFIB Small Business Optimism index improved in August as the outlook brightened. That said, we are coming from pretty depressed levels.

Mortgage credit availability declined for the sixth straight month in August, according to the MBA. “Mortgage credit availability declined slightly in August, as investors reduced their offerings of ARM and non-QM loan programs,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “As overall origination volume is expected to shrink in 2022, some lenders continue to streamline their operations by dropping certain loan programs to simplify their offerings. Additionally, with a worsening economic outlook and signs of cooling in home-price growth, the appetite for riskier loan programs has been reduced.”

As you can see from the chart below, mortgage credit is almost back to the bad old days in the aftermath of the bubble.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.