[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,931 | -23.50 |

| Oil (WTI) | 87.76 | -1.81 |

| 10 year government bond yield | 3.25% | |

| 30 year fixed rate mortgage | 5.81% |

Stocks are lower on continued Fed fears. Bonds and MBS are down.

The 10 year bond yield soared in the last hour of trading yesterday. I didn’t see anything in particular driving it and I assumed it was just month-end noise. The sell-off is continuing this morning, so perhaps that doesn’t explain it. Regardless, the market seems to be bracing for a blockbuster jobs report tomorrow.

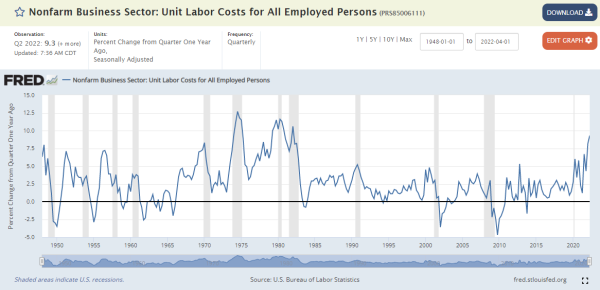

Some bad news for inflation: productivity fell 4.1% in the second quarter as output fell 1.4% and hours worked increased 2.7%. This number was a touch better than expectations, however. The bad number (at least for bonds and the Fed) was the 10.2% increase in unit labor costs, which was the highest since 1982. This as driven by a 5.7% increase in compensation and a 4.1% decrease in productivity. You can see in the chart below that we are getting back to levels last seen in the 1970s.

Interestingly, there is a bifurcation between manufacturing and non-manufacturing. Manufacturing productivity increased as output rose 4.1% and hours worked fell 0.7%. This mean that the service sector became highly inefficient during the quarter. Is this the quiet quitting phenomenon we have been reading about?

Announced job cuts fell 21% MOM to just over 25k, according to outplacement firm Challenger, Gray and Christmas. Announced job cuts are up 30% YOY however. “Employment data continue to point to a strong labor market. Job openings are high, layoffs are low, and workers seem to have slowed their resignations. If a recession is imminent, it’s not yet reflected in the labor data,” said Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. Separately, initial jobless claims fell 5k last week. Note job cuts in finance and fintech increased 765% to

Bottom line: while employment is a lagging indicator so far we aren’t seeing any evidence in the numbers that the job market is reacting to the increased fed funds rate. All eyes turn to the employment situation report tomorrow.

The ISM Manufacturing Index was flat in August, however the report generally contained good news. Most notably, the Prices index fell pretty dramatically and is back to June 2020 levels. Production fell while new orders increased. “The U.S. manufacturing sector continues expanding at rates similar to the prior two months. New order rates returned to expansion levels, supplier deliveries remain at appropriate tension levels and prices softened again, reflecting movement toward supply/demand balance. According to Business Survey Committee respondents’ comments, companies continued to hire at strong rates in August, with few indications of layoffs, hiring freezes or head-count reductions through attrition. Panelists reported lower rates of quits, a positive trend. Prices expansion eased dramatically in August, which — when coupled with lead times easing — should bring buyers back into the market, improving new order levels. Sentiment remained optimistic regarding demand, with five positive growth comments for every cautious comment.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.