[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,616 | 8.75 |

| Oil (WTI) | 89.84 | -1.51 |

| 10 year government bond yield | 3.93% | |

| 30 year fixed rate mortgage | 6.81% |

Stocks are lower as the UK continues to support its bond market and supply chain issues impact the chips market. Bonds and MBS are down.

The upcoming week has a lot of important data, especially with the consumer price index on Thursday. We will also get the FOMC minutes on Wednesday. We will also get the University of Michigan Consumer Sentiment data and retail sales on Friday.

Third quarter earnings season kicks off this week with the big banks all reporting late this week.

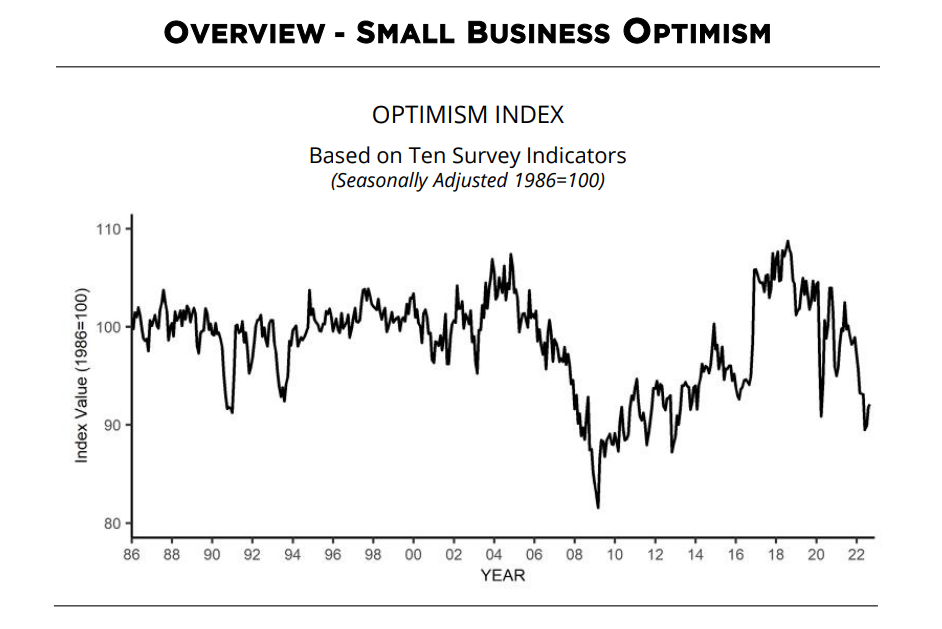

Small Business Optimism improved in September, according to the NFIB Small Business Optimism Index. Inflation remains the biggest problem, however fewer small business owners are raising prices. Jobs remain tough to fill, and expectations about the future declined.

The small business economy seems to be waiting for the other shoe to drop, as they expect that the economy will weaken as the rate hikes begin to impact the economy. We are looking at another 75 basis points in tightening at the November meeting, and the 225 in hikes since June will begin to have their effect in the coming months. As a general rule, monetary policy acts with a 6-9 month lag, so we are only beginning to feel the impact of these rate hikes. It will get worse before it gets better.

Mortgage credit continues to tighten and has fallen to a 9 year low, according to the MBA. Much of the impact is being felt at the low end of the credit spectrum. We continue to see lenders shrink their FHA footprint and take defensive measures ahead of a potential recession.

“With the likelihood of a weakening economy, which would lead to an increase in delinquencies, there was a smaller appetite for lower credit score and high LTV loan programs, along with a reduction in government streamline refinance programs,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “As mortgage rates have more than doubled over the past year, resulting in a drop in refinance activity, lenders have worked to reduce excess capacity and costs by eliminating underutilized loan programs. All the component indices declined last month, with most of the indices falling to their lowest levels in over a year. In particular, the government credit availability index has declined in seven of the last eight months to its lowest level since April 2013.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.