[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,949 | -21.25 |

| Oil (WTI) | 98.15 | 1.45 |

| 10 year government bond yield | 2.73% | |

| 30 year fixed rate mortgage | 5.64% |

Stocks are lower this morning as we get a slew of important earnings and the Fed meeting begins. Bonds and MBS are up.

Home price appreciation appears to be decelerating, according to the FHFA House Price Index. Home prices rose 1.4% MOM in May, which was a decrease from the downward-revised 1.6% in April. On a YOY basis, home prices are still up some 18.3%.

Separately, the Case-Shiller Home Price Index rose almost 20% in May. Prices remained the strongest in the South and Southwest. Rising mortgage rates will make gains like this unsustainable soon enough.

Agency mortgage REIT AGNC Investment reported that the mortgage backed securities market (where lenders sell their loans) was difficult in the second quarter. Tangible book value per share fell about 13%.

“Financial markets remained under significant pressure in the second quarter as the Federal Reserve indicated a more aggressive path of monetary policy tightening,” said Peter Federico, the Company’s President and Chief Executive Officer. “The expectation of materially higher short-term rates drove significant interest rate volatility and increased the probability of a recession. This challenging monetary policy and macro-economic environment led to broad-based financial market weakness during the second quarter. Agency MBS were no exception, as the spread between Agency MBS and swap and Treasury rates widened meaningfully in April and again in June.

“Looking ahead, while the near-term outlook continues to be uncertain, the longer-term outlook for Agency MBS has improved substantially. At current valuation levels, Agency MBS are extremely attractive relative to historical levels. The Federal Reserve has begun to reduce its portfolio organically, but that runoff will occur at a slower pace than previously anticipated as a result of reduced prepayments. Finally, and perhaps most importantly, the net supply of Agency MBS is now expected to be meaningfully lower than prior expectations.

“These positive developments provide reason for optimism that this period of weakness in the Agency MBS market is nearing its end. The favorable returns associated with Agency MBS in this wider spread regime and an improving technical outlook for mortgage supply and demand should provide a supportive backdrop for Agency MBS investors. Moreover, in this compelling investment environment, we believe AGNC is well-positioned to generate strong risk-adjusted returns for our stockholders.”

What all this means is that AGNC was hit hard by weakness in the mortgage backed securities market. When the company says that “spreads widened” it means that the interest rate on mortgages rose faster than the yield on the 10-year. However, the relative valuation of mortgage backed securities is the best it has been in a while, which means that spreads should tighten as volatility wanes. This means that mortgage rates will probably move lower if the 10 year stays here. This is good for origination, though we probably won’t see a return of the rate / term refi business unless rates move materially lower.

New home sales fell 8% MOM and 17% YOY to a seasonally-adjusted annual rate of 590,000. This came in well below consensus. Homebuilding (and the real estate sector in general) continues to punch below its weight.

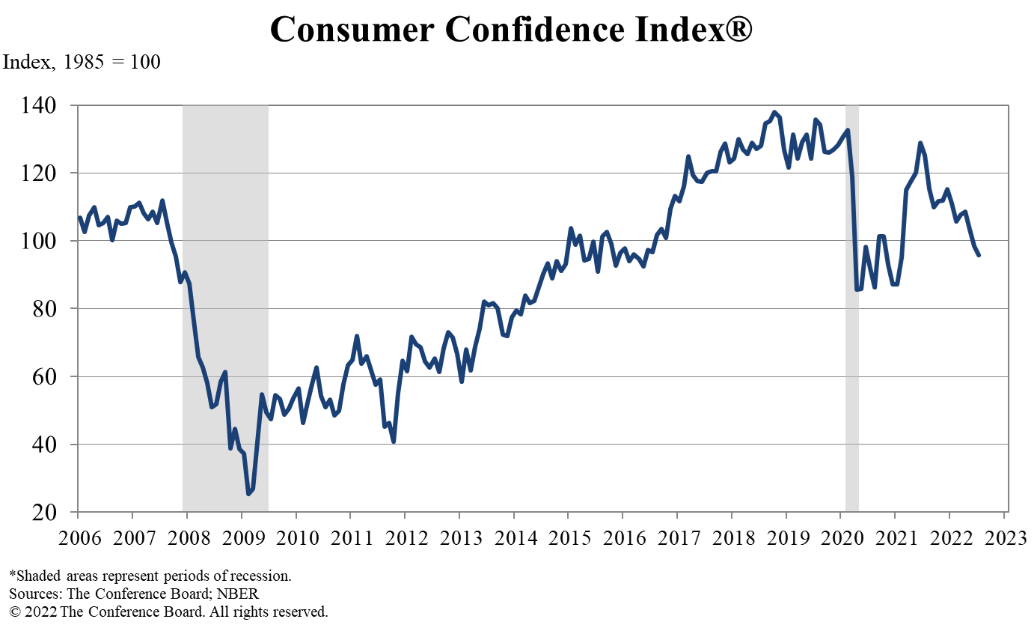

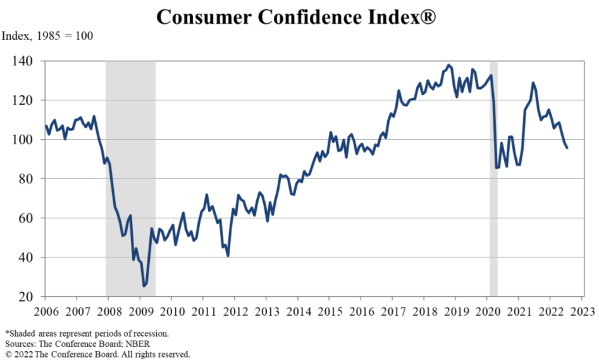

Consumers confidence continues to fall, according to the Conference Board. “Consumer confidence fell for a third consecutive month in July,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The decrease was driven primarily by a decline in the Present Situation Index—a sign growth has slowed at the start of Q3. The Expectations Index held relatively steady, but remained well below a reading of 80, suggesting recession risks persist. Concerns about inflation—rising gas and food prices, in particular—continued to weigh on consumers.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.