[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,665 | 4.25 |

| Oil (WTI) | 79.59 | 1.07 |

| 10 year government bond yield | 3.82% | |

| 30 year fixed rate mortgage | 6.79% |

Stocks are flattish this morning after US Treasury yields hit 3.94% overnight. Bonds and MBS are up.

Treasury yields spiked overnight on speculation that the Bank of Japan would intervene to support the yen by selling Treasuries. Regardless, global yields have been on a tear, with the German Bund now yielding 2.15%. Just over six months ago, the yield on the Bund was negative.

New Home Sales rose 29% MOM to a seasonally-adjusted annual pace of 685,000. This was flat YOY. I don’t think this means much in of itself – the standard errors for new home sales estimate are typically huge. I wouldn’t be surprised to see this one revised downward in coming months.

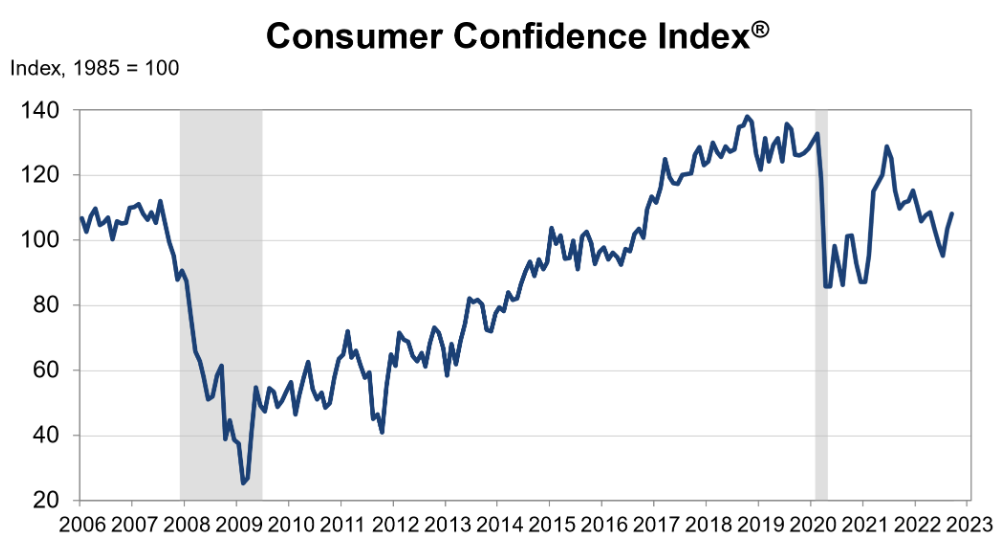

Consumer confidence improved in August, according to the Conference Board. These consumer confidence numbers are highly correlated with gasoline prices, however there is some good news about inflationary expectations.

“Consumer confidence improved in September for the second consecutive month supported in particular by jobs, wages, and declining gas prices,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index rose again, after declining from April through July. The Expectations Index also improved from summer lows, but recession risks nonetheless persist. Concerns about inflation dissipated further in September—prompted largely by declining prices at the gas pump—and are now at their lowest level since the start of the year.”

Mortgage applications fell 3.7% last week as purchases fell 0.4% and refis fell 11%. The refi index is 84% lower than it was a year ago. “Applications for both purchase and refinances declined last week as mortgage rates continued to increase to multi-year highs following more aggressive policy measures from the Federal Reserve to bring down inflation,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Additionally, ongoing uncertainty about the impact of the Fed’s reduction of its MBS and Treasury holdings is adding to the volatility in mortgage rates.”

The part about uncertainty is important. The Fed was relying on runoff to allow its portfolio of MBS to shrink. With refinances out of the picture, normal purchase activity will have to do the job. Which means the Fed might be pushed to sell some of its portfolio directly into the market. Jerome Powell was asked about that in his press conference following the September FOMC meeting. He basically said that this is nothing they are considering right now.

Speaking about mortgage backed securities, the mortgage REITs have been absolutely pummeled over the past week. AGNC Investment, which buys almost entirely agency securities is down 17% over the past 5 days. Annaly, which just did a reverse stock split is down by 16%. I am wondering if we are seeing margin calls again in the space. The stocks sure are acting like it.

Pending Home Sales slipped 2% in August and are down 24% on a YOY basis. “The direction of mortgage rates – upward or downward – is the prime mover for home buying, and decade-high rates have deeply cut into contract signings,” said NAR Chief Economist Lawrence Yun. “If mortgage rates moderate and the economy continues adding jobs, then home buying should also stabilize.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.