[ad_1]

- The price of gold continues its bearish trend that started last week after we climbed to the $1730 level, forming a new lower low on a larger time frame.

- After forming last week’s high at $21.23, the price of silver has been in a bearish trend since then.

Gold chart analysis

The price of gold continues its bearish trend that started last week after we climbed to the $1730 level, forming a new lower low on a larger time frame. During the Asian trading session, gold prices continued to retreat. Today’s low was at $1676, where we have an immediate hold for now. The price of gold could soon drop to the potential support zone of $1660-$1670.

If the price does not find support there, we will see a further decline to the previous low at the $1640 level. And if the dollar strengthens, gold could fall to $1,620 and once again look for support at the two-year low. For a bullish option, we need a new positive consolidation and a return above the $1690 level at the $38.2 Fibonacci. Then we must hold above and continue the recovery with a new bullish impulse. Potential higher targets are $1700 and $1710 at 50.0% Fibonacci.

Silver chart analysis

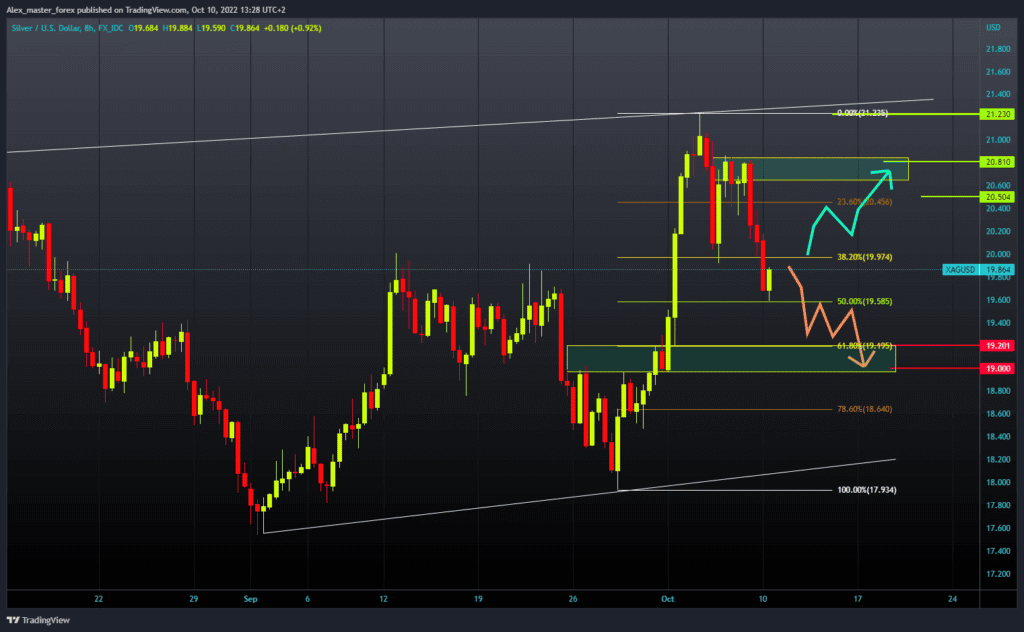

After forming last week’s high at $21.23, the price of silver has been in a bearish trend since then. With the Fibonacci setup, we can measure pullbacks. The first was stopped at the 38.2% level, then we see a recovery to $20.80, but not the formation of a new higher high. The price of silver is making a new pullback which was stopped today at the 50.0% Fibonacci, and we now have some support here at $19.60. Silver prices are recovering again to $19.90, and we are now following this bullish impulse to see where the next high will be.

The formation of a new lower high is a sign of a further weakening of the price of silver, and our potential target is the 61.8% Fibonacci level, the support zone of $19.00-$19.20. For a bullish option, we need a continuation of the current momentum and a price jump again to the $20.80 resistance level. A break above would greatly benefit us for a potential continuation of the price recovery. The next target is last week’s high at $21.23 level.

BONUS VIDEO: Weekly news summary from the markets

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.