[ad_1]

- The oil price managed to move from the $86.00 level today, and we are now at the $88.80 level.

- The price of natural gas rose to $9.73 yesterday. Then there was a pullback to $9.20.

- Economists at the Bank of Denmark expect oil prices to trade above $100 by the end of 2022, then fall to $95 in 2023.

Oil chart analysis

The oil price managed to move from the $86.00 level today, and we are now at the $88.80 level. MA20 and MA50 are now on a bullish star and are directing the price towards the $90.00 level. In the news yesterday, the EIA reported a major drop in oil inventories of over 7 million barrels. This kind of news should have had an immediate positive effect on the price, but the price increase has been postponed for today. We are currently consolidating around the $89.00 level. We need a positive consolidation and a move above the $90.00 level for a bullish option. At that level, we get additional support in the MA200 moving average. Potential higher targets are $91.00 and $92.00 levels. We need a negative consolidation and a new price pullback below the $88.00 level for a bearish option. After that, we could find ourselves in the support zone at the $86.00 level. Potential lower targets are $85.00 and $84.00 levels.

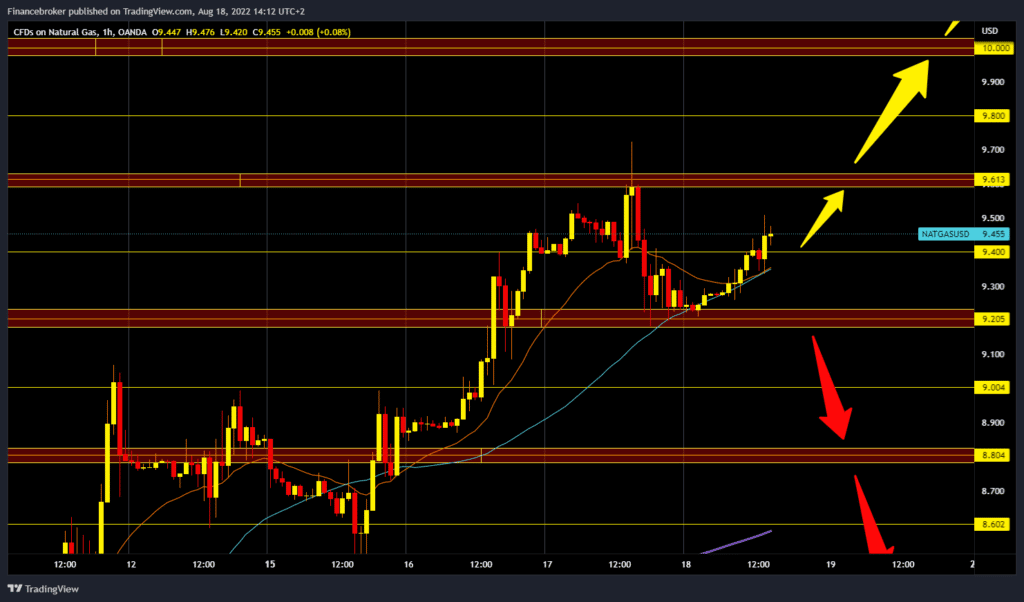

Natural gas chart analysis

The price of natural gas rose to $9.73 yesterday. Then there was a pullback to $9.20, and that’s where we found support. During the Asian trading session, the gas price initiated a new bullish consolidation, and we saw a break above the $9.40 level. We have support in moving indicators. We need a continuation of positive consolidation and a break above the $9.60 level for a bullish option. After that, we could try to stay above to prepare for the next bullish impulse. Potential higher targets are $9.80 and $10.0 levels. For a bearish option, we need a pullback of the gas price below the $9.20 level. Then the MA20 and MA50 will move to the bearish side, which would strengthen the bearish pressure. Potential lower targets are $9.00 and $8.80 levels.

Market overview

Economists at the Bank of Denmark expect oil prices to trade above $100 by the end of 2022, then fall to $95 in 2023. Yesterday’s EIA report saw a large oil withdrawal of 7 million barrels. Market participants believe that this demand trend could continue, and therefore the oil price increase would continue.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.