- The price of crude oil was stopped at the $90.00 level yesterday.

- The price of natural gas formed its new maximum at $9.70.

- The (API) reported that crude oil inventories fell by only 448,000 barrels this week.

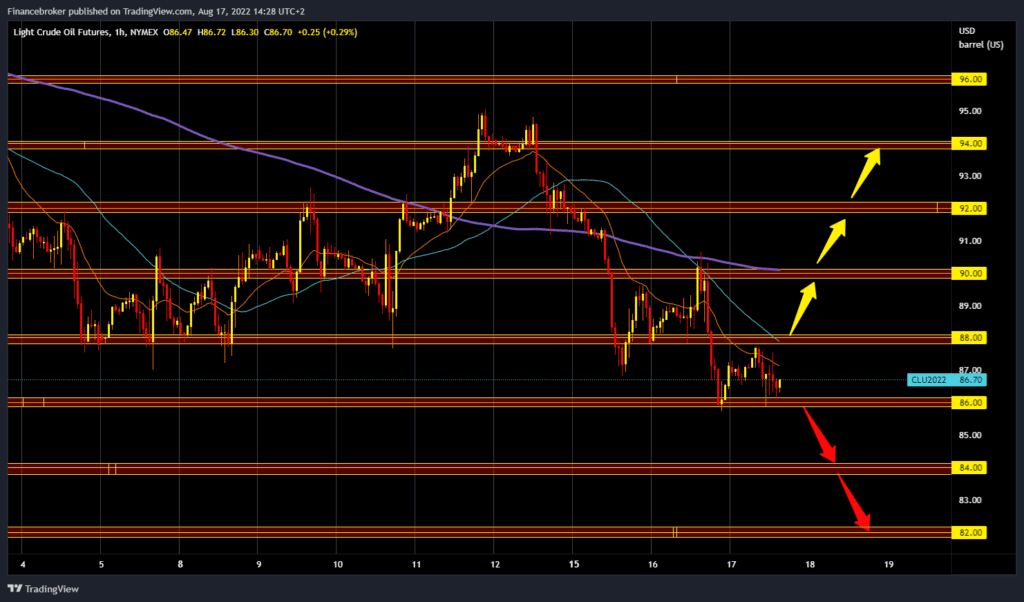

Oil chart analysis

The price of crude oil was stopped at the $90.00 level yesterday, after which a sharp drop to the $86.00 level followed. During the Asian trading session, the price of oil tried to climb above $88.00 but did not have the strength to make such a move. We again saw another price pullback to the $86.00 support zone. We need a continuation of the current negative consolidation and a break below the $86.00 support zone for a bearish option. Then there would be a continuation of the price decline, first to the $85.00 level and maybe even the $84.00 level. We need a positive consolidation and a return above the $88.00 level for a bullish option. If we manage to climb above, we get additional support in the MA20 and MA50 moving averages. With further bullish consolidation, we could continue towards the $90.00 level. Potential higher targets are $91.00 and $92.00 levels.

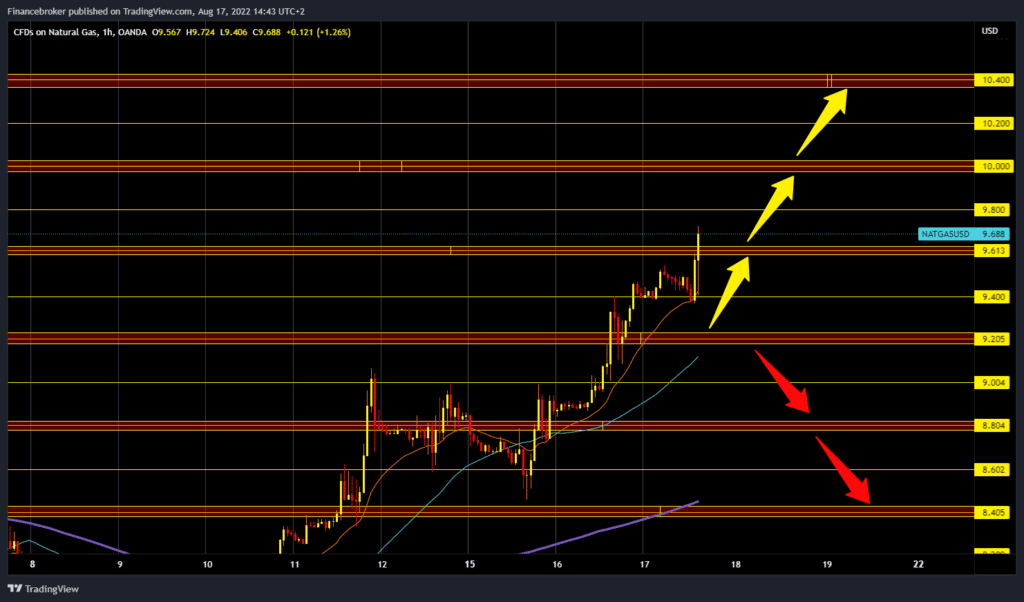

Natural gas chart analysis

The price of natural gas formed its new maximum at $9.70. The last time we were at this price was in June 2008. Yesterday the price advanced from $8.80 to $9.40. During the Asian trading session, it managed to stay at that level. At the beginning of the European trading session, the price stagnated, and then a bullish impulse pushed the price above the $9.60 level. For the bullish option, we now need to hold above the $9.60 level in order to consolidate better and initiate a new bullish impulse. Potential higher targets are $9.80 and $10.00 levels. We need a negative consolidation and price pullback to the $9.40 level for a bearish option. A gas price break would increase the bearish pressure, and we could expect further price pullback. Potential lower targets are $9.20 and $9.00, our larger support zone.

Market overview

The American Petroleum Institute (API) reported that crude oil inventories fell by only 448,000 barrels this week. The Ministry of Energy released 3.4 million barrels from strategic oil reserves in the previous week. Potential reasons for the drop in oil prices are disappointing economic data from China and improving prospects for a possible nuclear deal with Iran.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.