[ad_1]

- The oil price retested $92.00 yesterday, after which we saw the price drop to the $88.00 level.

- During the Asian trading session, the gas price somehow managed to hold above $8.20.

- WTI Oil dips below $90.

Oil chart analysis

The oil price retested $92.00 yesterday, after which we saw the price drop to the $88.00 level. During the Asian trading session, the price of oil recovered to the $89.40 level. There we now have a new obstacle, and the price is once again turning towards the $88.00 support zone. We need a continuation of negative consolidation and a drop below this morning’s support zone for a bearish option. Potential lower targets are $87.00 and $86.00 levels. We need a positive consolidation and a return above the 90,004 level for a bullish option. Then we need to hold above to consolidate and continue further towards the $92.00 level. Additional support for us is the MA20 and MA50 moving averages. If we manage to get back above $92.00, we could say that we are entering a safer zone for the price of oil, the range of $92.0-98.00.

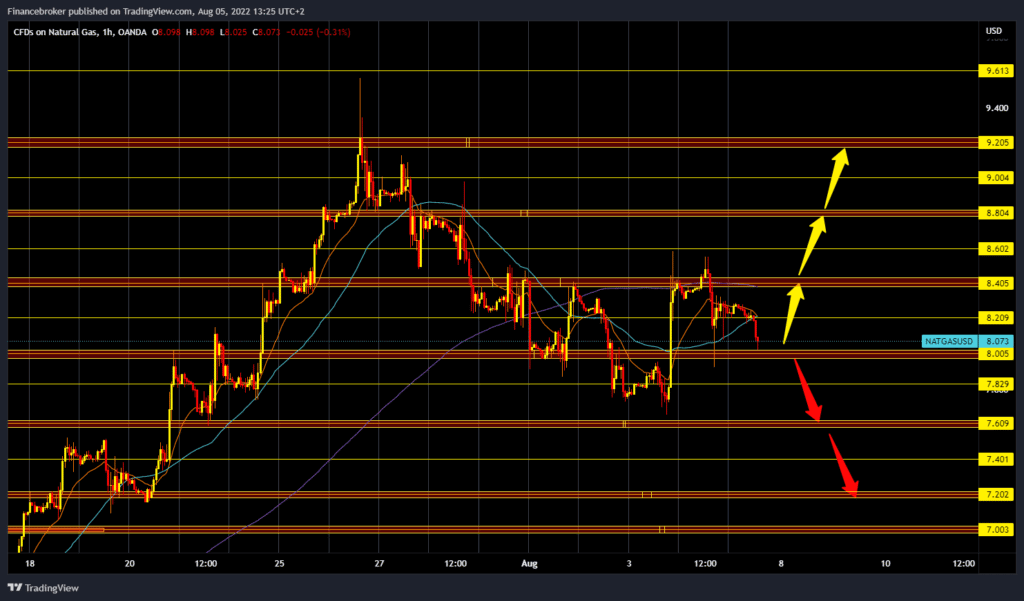

Natural gas chart analysis

During the Asian trading session, the gas price somehow managed to hold above $8.20, and as the European session began, the price fell to $8.00, looking for that support. Increased pressure on the current support zone could create a break below. Potential lower targets are $7.80 and 7.604 levels. For a bullish option, we need a new positive consolidation and first a return above $8.20. After that, we could try again to climb to the $8.40 level. If the price manages to maintain at that level, our potential higher targets are $8.60 and $8.80 levels.

Market overview

WTI Oil dips below $90

The value of US crude fell early Thursday to its lowest level in months, falling below $90 a barrel for the first time since Russia invaded Ukraine in late February. The international benchmark, Brent crude, also fell, trading below $100 a barrel for the second day in a row, amid a global economic slowdown and fears of a recession, which could slow demand growth this year compared to last year. Oil prices fell 4% on Wednesday to levels just before Russia’s invasion of Ukraine, after the US Energy Information Administration reported a big 4.5-million-barrel rise in crude inventories for the week to July 29. The main bearish signal for oil appears to come from Energy Information Administration data showing an unexpected and significant increase in US commercial crude oil inventories and a gasoline demand drop.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.