Vital Statistics:

| Last | Change | |

| S&P futures | 4,116 | 21.25 |

| Oil (WTI) | 94.45 | -0.20 |

| 10 year government bond yield | 2.78% | |

| 30 year fixed rate mortgage | 5.32% |

Stocks are higher this morning as earnings continue to come in. Bonds and MBS are down.

Bond yields had been falling over the past few days based on hope that the Fed will pivot to a more normal policy as the economy weakens. So far, we haven’t seen much in the way confirmation from Fed officials, and at least some of it might be wishful thinking. That said, the Fed funds futures still see another 100 basis points in hikes through the end of the year, and then the cycle appears to be over.

Mortgage applications increased 1.2% last week as purchases rose 1% and refis increased 2%. The drop in rates spurred the activity. “Mortgage rates declined last week following another announcement of tighter monetary policy from the Federal Reserve, with the likelihood of more rate hikes to come,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Treasury yields dropped as a result, as investors continue to expect a weaker macroeconomic environment in the coming months.”

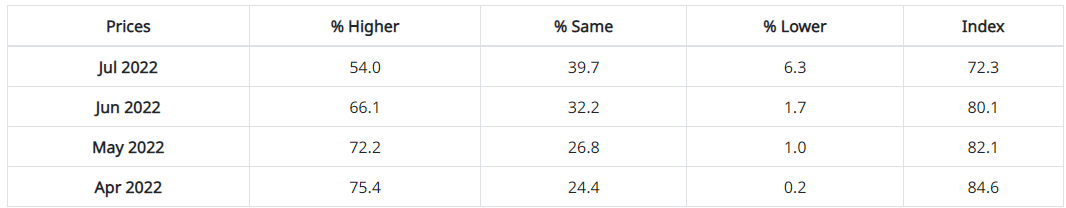

The service economy expanded in July, according to the ISM Services Index. It was an improvement from June’s reading which had shown some softening in demand and prices. Most importantly, the prices index fell for the third month in a row. You can see the trend in prices in the table below:

Retailers in particular are noticing that demand is softening as consumers are switching from discretionary goods to essentials. The employment sub-index improved.

One of the respondents discussed the housing market: “Interest rates have significantly impacted the homebuilding market. Cancellation rates have increased, as homebuyers can no longer afford the monthly payment. Traffic to our communities is down. Inflation has sidelined many would-be buyers.” [Construction]