[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,133 | -9.00 |

| Oil (WTI) | 92.42 | 1.73 |

| 10 year government bond yield | 2.79% | |

| 30 year fixed rate mortgage | 5.44% |

Stocks are lower this morning as we await tomorrow’s Consumer Price Index reading. Bonds and MBS are flat.

Some good news for the Fed: inflationary expectations fell in July as declining gas prices improved sentiment. Longer-term expectations fell from 6.8% to 6.2%. The 3 year expected inflation index fell from 3.6% to 3.2%.

Some bad news for the Fed: productivity declined 4.6% in the second quarter. Output fell 2.1% and hours worked increased 2.6%. Unit labor costs rose a whopping 10.8%, which was driven by a 5.7% increase in compensation and a 4.6% decline in productivity. This is the largest increase in unit labor costs in 40 years.

Rising productivity is a major factor in controlling inflation. Productivity was lousy in the 1970s, and usually corresponds with a recession. You can see in the chart below, we are at exceptionally low levels.

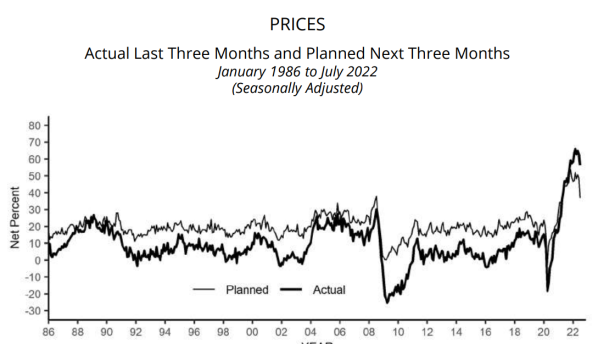

Small Business Optimism rose in July according to the NFIB. This is the sixth consecutive month below the historical average of the index. 37% of respondents said that inflation was their biggest concern, which was the highest since 1979. That said, it looks like pricing pressures are beginning to ease a touch, although we are still quite elevated.

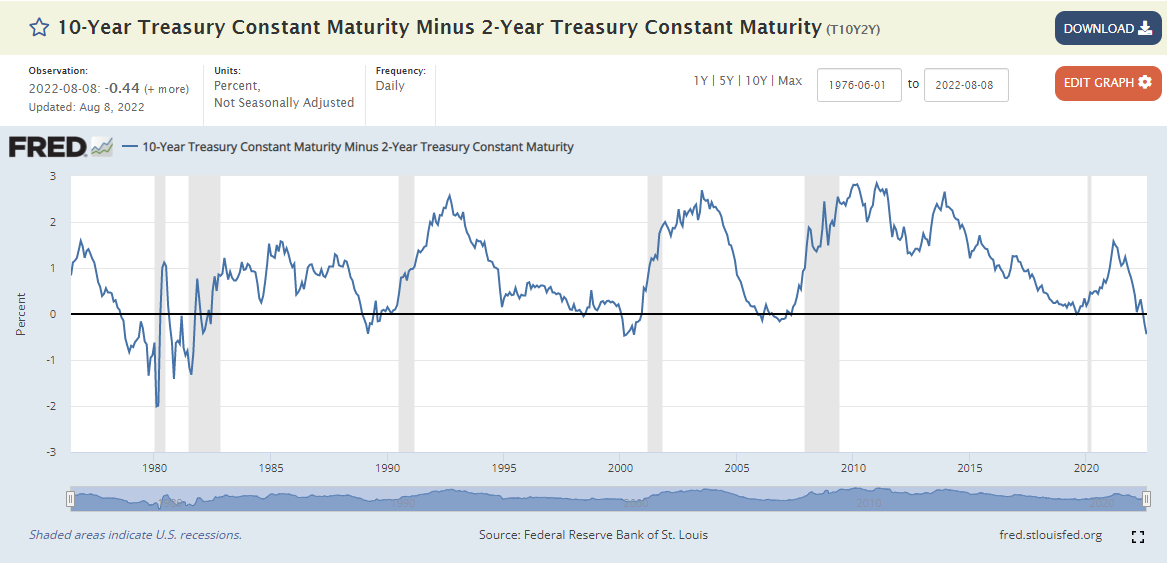

The yield curve continues to invert, with the spread between the 10 year and the 2 year now 47 basis points. This is another recessionary signal. The market is waiting for some indication that inflation is moderating which will mean the Fed can pivot from hawkishness to neutrality.

The decrease in the 10 year is perplexing given inflationary expectations. I mean, why would you want to tie up your money for 10 years at 2.8% when inflation is running in the high single digits? That said, I suspect that sovereign debt is being supported by Chinese investors who are worried about the bursting of their real estate bubble. It isn’t just Treasuries that are seeing lower rates – German Bunds and Japanese government bonds are as well.

As the Chinese real estate bubble bursts, the government is going to protect homeowners first and investors second. For example remember troubled developer Evergrande? Its bonds are trading at 7 cents to the dollar. As China’s real estate bubble bursts, domestic demand is going to plummet, which means the trade deficit with China is about to blow out. And if the Chinese aren’t going to be buying US goods and services in exchange for their goods and services, they will be buying Treasuries instead.

Mortgage credit availability fell to the lowest level in 9 years, according to the MBA. “Credit availability fell last month to the lowest level since May 2013, as lenders streamlined their loan offerings in this declining volume environment,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “The 9 percent decline in the July index was the largest monthly decrease since April 2020. Lenders have responded accordingly to the decrease in demand for refinance and purchase loans by reducing loan offerings, including for ARMs, cash-out refinances and investment properties.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.