[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,836 | -11.25 |

| Oil (WTI) | 75.74 | 0.54 |

| 10 year government bond yield | 3.68% | |

| 30 year fixed rate mortgage | 6.32% |

Stocks are lower this morning after the Bank of Japan unexpectedly increased rates. Bonds and MBS are down.

The Bank of Japan announced it will allow its 10 year bond yield to rise up to 0.50%. This was a surprise announcement, and we are seeing reverberations throughout global sovereign debt markets. Most benchmark yields are up about 10 basis points this morning, and the US 10 year is up to 3.68%. While this is a surprise, I think the global narrative is moving from global inflation to a global recession, which will push rates lower next year.

Housing starts in November fell to a seasonally-adjusted annual rate of 1.427 million units. This is flat with October and down 16.4% compared to a year ago. Building Permits fell 11% MOM and 22% YOY to a seasonally-adjusted annual rate of 1.342 million. Rising rates and higher construction costs have caused the builders to hold off until things normalize. I do wonder on the last part if work from home will cause a change in mindset for builders. It would seem that exurbs will become more popular again as a way for builders to avoid the zoning and land availability headaches of building close to urban areas.

The MBA put out its forecast for 2023. Total originations are expected to fall to $1.9 trillion. The first quarter of 2023 is projected to be the nadir for this cycle, with total originations expected to fall to $345 billion before increasing to $510 billion in Q2, where it will begin to increase throughout the year. To put 2023 into perspective: it will be similar to 2018, and much better than 2014.

Mortgage rates are expected to fall throughout 2023, with the 30 year mortgage rate falling to 5.2% by the end of the year. Housing starts are expected to remain depressed around 1.4-1.5 million per year. Existing home sales are expected to remain on the low side, however they will improve throughout the year. Finally, home price appreciation should plateau and turn negative at the end of 2023, although we aren’t talking a crash, just low single digit decreases.

Historically, housing has led the economy out of a recession, and we have historically seen housing starts reach something like 2 billion in early stage recoveries. This was the missing piece of the puzzle in the post-2008 recovery, and it seems that forecasters don’t expect it to ever return. Housing starts of 1.4 million units are the pre-bubble historical average since the late 1950s. Given that the US population has been growing since then there are more heads that need beds. The National Association of Realtors sees a 5 – 6 million unit deficit in needed housing, so the demand is there. I suspect the surprise of 2023 will be a rebound in homebuilding. It can’t stay depressed forever.

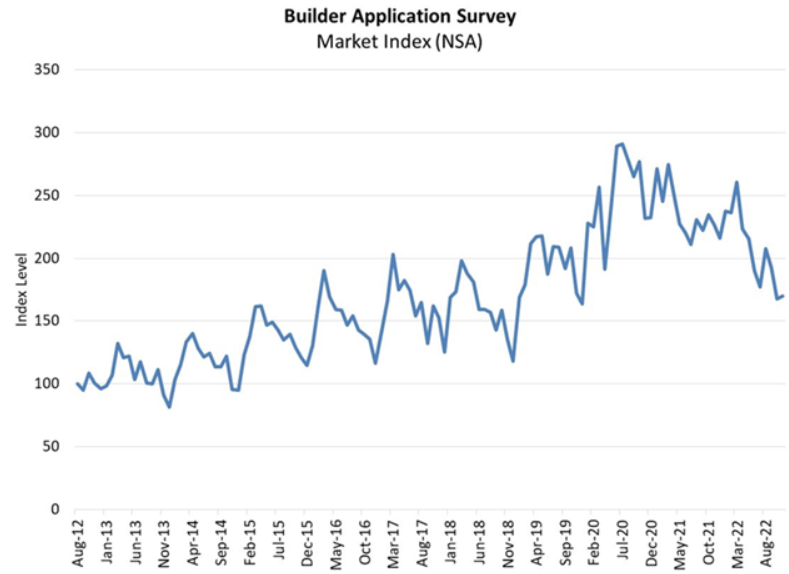

New home applications rose 1% in November, according to the MBA. “New home purchase applications recovered slightly in November, as mortgage rates retreated from their October highs and brought some prospective buyers back into a market that still faces affordability challenges,” said Joel Kan, MBA Vice President and Deputy Chief Economist. “Similarly, estimated new home sales for November saw an annual pace of 660,000 units – a 10 percent increase from October. While mortgage rates remain high compared to the past few years, the 30-year fixed rate was 6.49 percent at the end of November after reaching 7.16 percent in mid-October, providing a slight boost in purchasing power for buyers. However, both applications and sales remained over 20 percent below last year’s pace.”

Like everything else, we are back at 2018 levels.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.