[ad_1]

Covered call writing is defined as first purchasing or already owning the underlying security and then selling the corresponding call option. By doing so, we are protected; we know our cost-basis. A BCI member proposed to me an extreme bear market strategy where a deep out-of-the-money (OTM) call is sold first and if the stock appreciates significantly, against market trend, we can buy that security prior to the strike moving in-the-money. This article will analyze the pros & cons of such an approach.

Real-life example with SPY

- 6/17/2022: SPY trading at $365.40

- 6/17/2022: The $400.00 deep OTM 7/18/2022 call shows a bid price of $1.56 per-share

- 6/17/2022: Sell the naked call first and plan to purchase SPY if the price appreciates near the $400.00 strike

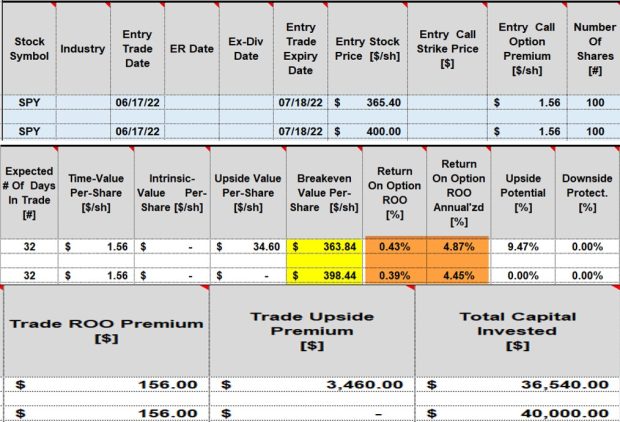

BCI Trade Management Calculator showing initial returns at the current and $400.00 price points

SPY: Reverse Covered Call Writing Calculations

The annualized returns whether shares are purchased or not, are between 4% and 5% (brown cells).

Strategy advantages

- In a bear market, holding long positions can result in significant losses

- Selling low-Delta, deep OTM calls have low probability of exercise

Strategy disadvantages

- The upside is the premium generated for a deep OTM call strike which, by definition for a security like SPY, would be miniscule

- If we are forced to buy the security as price approaches the deep OTM strike, the % return would be similarly miniscule, even a bit less (brown cells for 1st 2 bullets)

- Naked option trading requites a higher level of trading approval that most retail investors would have a difficult time obtaining

An alternative consideration

Sell deep OTM cash-secured puts that generate a pre-defined initial time-value return goal range because we know our cost-basis in advance (the cash required to secure that put trade). In this case, if the trade does turn against us and share price declines below the put strike, shares are purchased at a discount from when the trade was initially executed.

Discussion

There are many ways to craft our option-selling portfolios in extreme bear market conditions. Naked option selling is not appropriate for most retail investors even with a plan to purchase the underlying should the trade turn against us. In addition, it would be difficult to receive approval for such trading.

Holiday discount coupon

holiday15-1

Good for all items in the BCI store and for our Best Discounted Packages

Premium Member Benefits Video

This is a great time to join our premium member community with its stock screening and educational (over 200 videos) benefits. We offer more benefits than ever before. For information, click here.

For video explanation, click here.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Dr. Ellman!

Many thanks and it was an honor and pleasure meeting with Barry and yourself.

The presentations clarified a great deal and will help me better focus on the methodology and effect it more profitably.

Also, thanks for the TMC Package; the spreadsheet/calculator is exactly what’s needed. My hand-written calculations were getting tedious.

I look forward to future interactions with you, Barry, and your entire Team.

Art

Upcoming events

To request a private webinar for your investment club, hosted by Alan & Barry: [email protected]

1. Mad Hedge Traders and Investors Summit

Thursday December 8th at 12 PM ET (registration link to follow)

Covered Call Writing: Multiple Applications Based on Current Market Conditions

Real-life examples with Invesco QQQ Trust (Nasdaq: QQQ)

Covered call writing is a low-risk option-selling strategy geared to generating cash-flow with capital preservation as a key requirement. This presentation will demonstrate how the strategy can be crafted to succeed in all market environments.

Market situations highlighted are:

- Normal-to-bull markets

- Bear and volatile markets

- Low interest rate environments

This webinar will include specific methods to set up ultra-low-risk paths to set up trades with 84%+ probability of success.

2. Long Island Stock Traders Meetup Group (Private webinar)

Analyzing a 1-Month Covered call Writing Portfolio from Start to Finish

Thursday February 16,2023

7:30 PM ET- 9 PM ET

A real-life example with a $100k ETF Select Sector SPDR portfolio

Covered call writing is a low-risk option-selling strategy that generates weekly or

monthly cash flow. This presentation will demonstrate how to implement this

strategy using a database of only 11 exchange-traded funds for a 1-month option

contract cycle. These are real-life trades taken directly from one of Dr. Ellman’s

portfolios with screenshots verifying each trade. A final monthly contract result

compared to the performance of the S&P 500 will be calculated.

Topics included in this webinar:

What are the Select Sector SPDRs?

How to establish a covered call writing portfolio

What is the role of diversification?

What is the role of cash allocation?

Calculating initial returns

Analyzing each trade in the monthly contract

Final results

Next steps

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

[ad_2]

Image and article originally from www.thebluecollarinvestor.com. Read the original article here.