[ad_1]

Exit strategy implementation is a critical aspect of successful covered call writing and put-selling strategies. Over the years, we have discussed rolling options as an integral part of our position management arsenal. This article will detail a new rolling strategy… rolling-in.

Rolling definitions

- Rolling-up: Close out options at a lower strike and open options at a higher strike

- Rolling-down: Closing out options at one strike price and opening options at a lower strike price

- Rolling-out (forward): Closing out options at a near-term expiration and opening at the same strike at a later date. Can be combined with rolling-up or rolling-down.

- Rolling-in: Closing out options at a current-term expiration and opening at the same strike at an earlier date

When to consider rolling-in

Avoid risky corporate or market events

- Earnings reports

- Fed announcement

- FDA product announcement

- Corporate news conference

- Political events

Personal business commitments: unavailable to monitor trades

- Family vacation

- Business trip

- Hospital stays/medical reasons

Must liquidate position by a specific date

- Cash needed for other obligations

Real-life example with Etsy, Inc. (NASDAQ: ETSY)

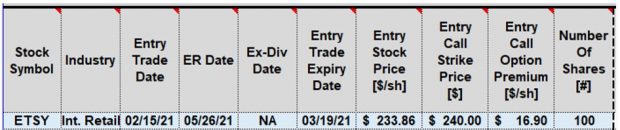

- 2/15/2021: Buy 100 x ETSY at $233.86

- 2/15/2021: STO 1 x 3/19, 2021 $240.00 call at $16.90

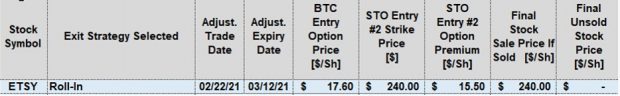

- 2/22/2021: BTC 1 x 3/19/2021 $240.00 call at $17.60

- 2/22/2021: STO 1 x 3/12/2021 $240.00 call at $15.50

- 3/12/2021: ETSY trading at $242.11 and exercise is allowed as shares are sold at the $240.00 strike

Initial trade entries

ETSY: Initial Trade Entries

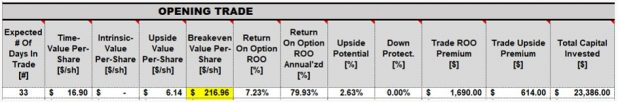

Initial trade returns

ETSY: Initial Trade Returns

The spreadsheet shows a 33-day initial return on the option (ROO) of 7.23% with an additional upside potential of 2.63%, should share price rise to the $240.00 OTM strike by expiration. The total potential maximum return is 9.86%.

Trade adjustment entries

ETSY: Trade Adjustment Entries

The 3/19/2021 expiration is rolled-in to the 3/12/2021 expiration at a net option debit of $$2.10 ($17.60 – $15.50).

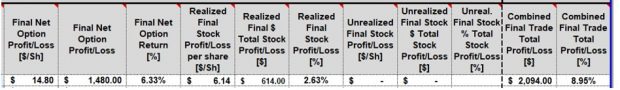

Final calculations

ETSY: Final Adjusted Calculations

The spreadsheet shows a final combined stock and option return of 8.95%, slightly lower than the initial maximum return of 9.86%. Keep in mind that the cash involved the trade will have an additional week to re-invest to mitigate the minor decrease in the maximum return. However, the exit strategy avoided a potential risky event in the final week of the March contracts.

Discussion

Rolling-in is a new and additional position management technique that can be utilized to avoid risky evets as well as allow for better management and needs. The cost to roll-in will typically be low or may result in a higher annualized return but will always lower the overall risk inherent in our portfolio positions.

New Book Discount Offer (through August 1st)

My new book, The Blue Collar Investor’s Guide to: Exit Strategies for Covered Call Writing and Selling cash-Secured Puts is now available in the BCI store. We are offering an early order $5.00 discount for the softcover version:

Use promo code: newesbook5

Click here for more information

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan,

I just listened to your presentation! It was very clear and concise, with great examples.

Thank you.

Tanya

Upcoming event

Money Show Orlando live event

October 30th – November 1st, 2022

OMNI ORLANDO RESORT AT CHAMPIONSGATE

Visit Alan, Barry and members of the BCI team at Booth # 415

Sunday, October 30, 2022, at 5:00 pm – 5:45 pm EDT

Covered Call Writing: Multiple Applications Based on Current Market Conditions

Monday, October 31, 2022, at 4:30 pm – 6:30 pm EDT

Selling Cash-Secured Puts: Detailed Start-to-Finish Six-Part Program*

Masters Class

Comprehensive Course on Selling Cash-Secured Puts

Detailed start-to-finish 6-part program

This presentation will provide all the information, with real-life examples, necessary to master the strategy of selling cash-secured puts. The program is divided into 6 sections:

- Section I:

- Section II

- Section III

- Section IV

- Section V

- Ultra-low-risk put/Delta strategy

- Section VI

This presentation was developed to benefit both beginner and experienced option traders and will provide all the information needed to initiate the strategy and elevate returns to the highest possible levels.

45-minute presentation

Covered Call Writing: Multiple Applications Based on Current Market Conditions

Real-life examples with Invesco QQQ Trust (Nasdaq: QQQ)

Covered call writing is a low-risk option-selling strategy geared to generating cash flow with capital preservation a key requirement. This presentation will demonstrate how the strategy can be crafted to benefit in all market environments. Market situations highlighted are:

- Normal to bull markets

- Bear and volatile markets

- Low interest-rate environments

A popular large-cap technology exchange-traded fund, Invesco QQQ Trust, will be used to establish rules and guidelines to benefit in these market circumstances.

Registration link and more details to follow.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

[ad_2]

Image and article originally from www.thebluecollarinvestor.com. Read the original article here.