[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,690 | -40.25 |

| Oil (WTI) | 82.66 | 0.55 |

| 10 year government bond yield | 3.78% | |

| 30 year fixed rate mortgage | 6.64% |

Stocks are lower this morning after Chicago Fed President Charles Evans reiterated hawkish comments. Bonds and MBS are down.

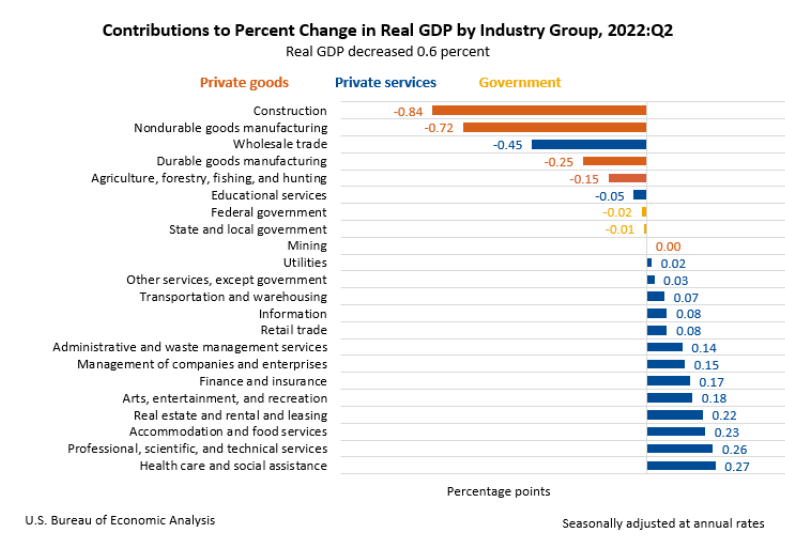

Second quarter GDP declined 0.6% in its third revision. This was unchanged from the second revision. Personal consumption expenditures were revised up from 1.5% to 2.0%. The PCE Price Index (i.e. inflation) was revised upward as well from 7.1% to 7.4%. Construction and durable goods manufacturing were drags on GDP.

So far the carnage in the financial markets hasn’t affected the labor market. Initial Jobless Claims fell to 193k last week. Historically sub-200k readings are exceedingly rare.

Finance of America is supposedly shutting down it retail mortgage origination business to Guaranteed Rate. It will also shut down its wholesale channel. This is all speculation – the company is not commenting. It sounds like it will retain the reverse mortgage business, and Incenter which is its MSR business. Capacity continues to be drawn out of the business.

Home affordability is well below historical averages, according to analysis by ATTOM. The combination of rising rates and home prices are the big driver. The bright spot is that incomes are rising as well. In fact, the portion of average wages required to support housing expenses fell from 30.9% to 30%.

“Homeownership remains largely unaffordable for the majority of homebuyers in the majority of markets across the country,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “While home prices have declined a bit quarter-over-quarter, they’re still higher than they were a year ago, and interest rates have essentially doubled. Many prospective homebuyers simply can’t afford the home they hoped to buy, and in many cases no longer qualify for the mortgage they’d need.

Home price appreciation has slowed dramatically in most markets – and there are even price corrections in some areas – as home sales have declined significantly over the past few months,” Sharga added. “But mortgage rates have risen more rapidly and dramatically than they have in several decades, and as a result a monthly mortgage payment today is 35-45 percent higher than a year ago, making affordability too much of a challenge for many would-be buyers.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.