[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,024 | 1.25 |

| Oil (WTI) | 99.01 | 1.85 |

| 10 year government bond yield | 2.68% | |

| 30 year fixed rate mortgage | 5.59% |

Stocks are flat after GDP came in negative for the second consecutive quarter. Bonds and MBS are up.

The Fed hiked the Fed Funds rate 75 basis points yesterday as expected. The vote was unanimous. Jerome Powell made hawkish remarks during his press conference. The prepared remarks are here. The money quote:

My colleagues and I are strongly committed to bringing inflation back down, and we are moving expeditiously to do so. We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses…. From the standpoint of our Congressional mandate to promote maximum employment and price stability, the current picture is plain to see: The labor market is extremely tight, and inflation is much too high.

The September Fed Funds futures contracts are pricing in a 80% chance of a 50 basis point hike and a 20% chance of a 75 basis point hike. For the end of the year, the December futures are seeing the Fed Funds rate up either 75 or 100 basis points from here. The June 2023 futures see lower rates than December. In other words, we are probably about 75% of the way through this tightening cycle. Of course the economic effect of tightening starts to be felt in six to 9 months, so late 2022 / early 2023 will be when the impact really begins to be felt.

The advance estimate for second quarter GDP came in at -0.9%, which is the second consecutive quarter of declining GDP. GDP was negatively affected by inventory investment, government spending, and housing. Personal Consumption Expenditures were positive. The PCE Price Index rose 7.4%, the same as the first quarter. Note this is probably not going to influence the Fed much given it is older data.

As I am sure you will hear in the media and from the Administration, two consecutive quarters of negative GDP growth is not an official recession. The National Bureau of Economic Research makes the final determination, and given the strength of the labor market they have the leeway to say we aren’t in one.

Of course as the economy weakens due to the recent rate increases, the NBER might have to bow to reality and declare one. But they will probably hold off as long as they can. Note that initial jobless claims are ticking up again, hitting 256k last week. The prior week’s 251k reading was revised upward to 261k.

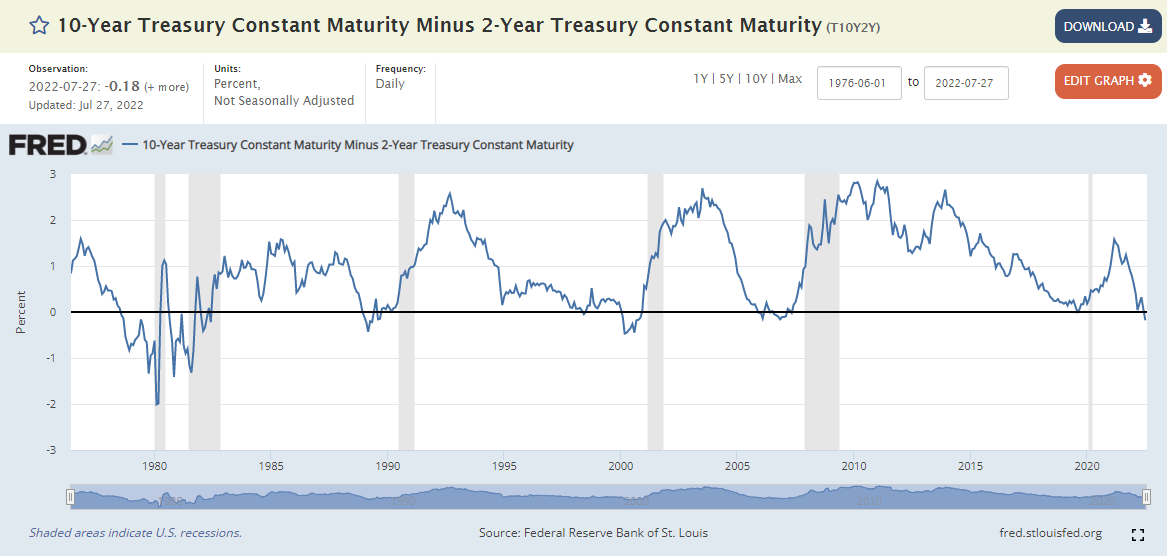

The GDP print and the Fed’s hawkishness is pushing the bond market up (rates down), which is creating an interesting dynamic. The yield curve inversion remains, with the 2s / 10s spread at negative 21 basis points. If the Fed raises rates another 50 basis points in September and the 10 year stays here, we will have a fully inverted yield curve. You can see below the 2s / 10s spread going back to the 1980s. It has been a decent recessionary indicator, although you could argue we are in one now.

Mr. Cooper’s earnings came in better than expectations, and the stock traded up about 5 bucks on the news. Net income came in at $151 million, which was driven primarily by servicing, although origination income was positive as well. Volume fell 33% QOQ to $7.8 billion. Mr. Cooper is valuing its servicing book at 155 basis points.

Mr. Cooper has held up better than most originators during this environment due to the relative size of its servicing book. If rates stabilize or start heading downward, that tailwind will probably weaken.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.