[ad_1]

Dear Mr. Market:

Does the old stock market adage of “sell in May and go away” make sense? We’ve actually written about this one spring about nine years ago where we actually advocated taking some chips off the table, however it had less to do with a cute stock market rhyme and more due to profit taking. Where are we at now going into May and is this allegedly poor seasonal time of year appropriate to sell or perhaps not?

If you read our article on the possibility of this seasonal market behavior you’ll note that we don’t normally believe in it (at least not this May). At the time of our writing in 2013 the market was climbing a “wall of worry”. We always preach about people having short-term memory issues and emotions take hold more than does disciplined decision making. If you need a refresher from that time period where 2013 opened up the year +13%, it was very different from the -13.3% we’re experiencing now. At the time we had the Fiscal Cliff, issues in Europe, the Debt Ceiling and a host of other market concerns. That all being said, we felt it was time to take chips off the table and bank some profits; that’s nowhere near where we are now with market action and sentiment completely in the toilet!

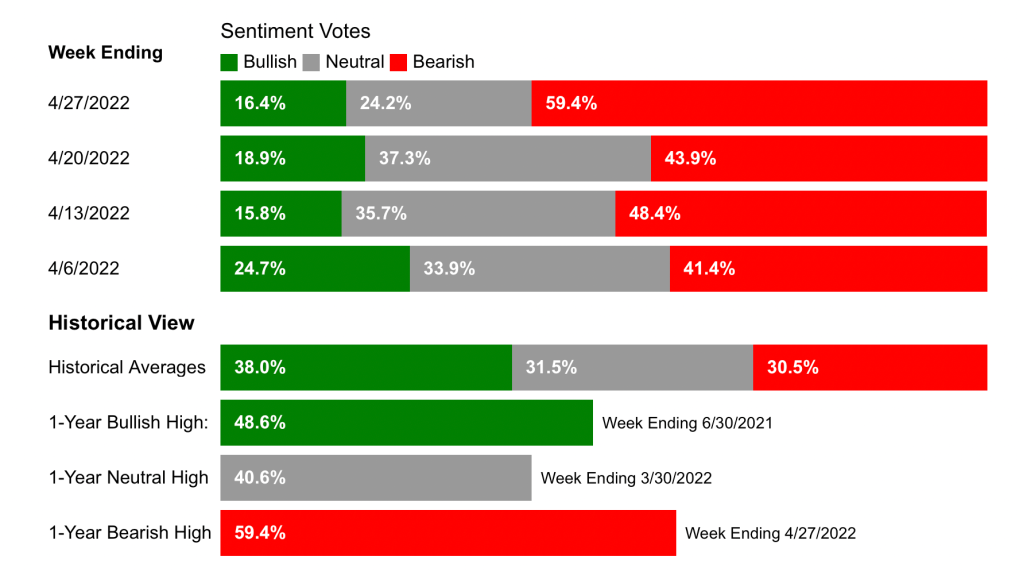

Stock market sentiment, as gauged my the latest AAII Sentiment Survey is as bearish as its been in almost 30 years. People have obvious reason to be concerned and the flows leaving equity and “risk on” asset classes certainly show that. If this letter we’re writing today was filled with negative reasons to get defensive you would inevitably be nodding your head in accord and think it was a smartly written piece. Fear sells and negativity sounds more intelligent than it usually ever is. What ever happened to “buy low sell high”? This stock market mantra typically only happens with eyes staring in the rear view mirror. The problem now is that there are very few spots to hide.

Bonds have historically been the safe place to hide in times of market turmoil but they’ve been decimated like rarely before. Year to date, the aggregate bond index is down -9.8%. That leaves little respite for the Nasdaq being down -17.7%, International down -18.8%, Emerging Markets down -12.5%, Small caps down -12.8%, and Mid caps down -10%. The only bright spot has been Gold up +3.49% and Commodities up +27.02%. So do you really think now is the time to get defensive?

If you’re concerned about inflation, sitting in cash will feel like a good spot to be in although that’s quite debatable. Seeing inflation at the pump and grocery store is painful but we don’t realize how bad it hits investments over time. If you lived through it in the 1980s or have studied your market history, you’ll recall inflation hit 14.6% in 1980. Guess what? Inflation is actually a lot worse than what the government reports it to be now. Matter of fact, if we used the same market methodology used during the Carter administration we would see it at 16% using those same metrics!

Look…we’re not trying to “put lipstick on a pig” or play the contrarian game, but to think that now is the time to sell and lay low until things get better is likely not going to pan out. Granted, taking the other extreme stance and stubbornly throwing good money after bad is also not wise.

One last thing to note on what the AAII Sentiment Survey reveals is that when we’ve hit bearish sentiment of this magnitude, the following six to 12 month periods are typically well above average.

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” Peter Lynch

[ad_2]

Image and article originally from dearmrmarket.com. Read the original article here.