[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,895 | -18.50 |

| Oil (WTI) | 74.96 | 0.33 |

| 10 year government bond yield | 3.60% | |

| 30 year fixed rate mortgage | 6.28% |

Stocks are lower as we await Jerome Powell’s speech in Sweden. Bonds and MBS are up.

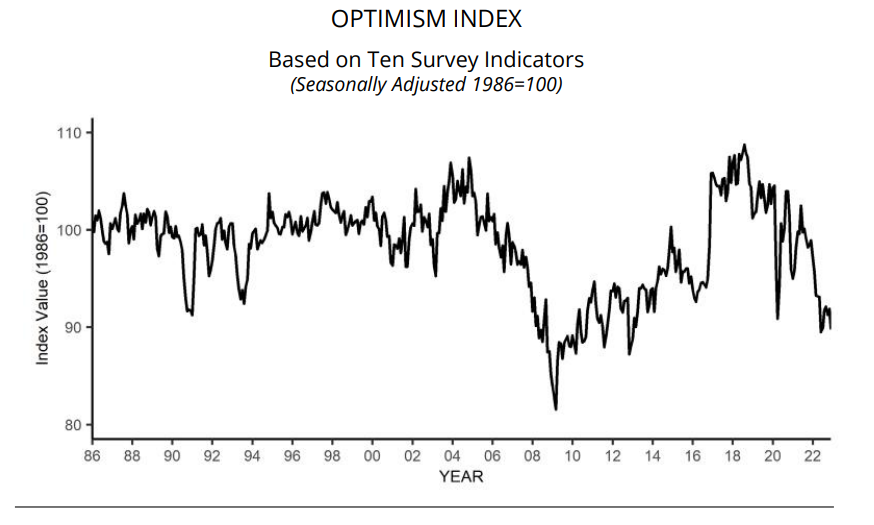

Small Business Optimism declined in December, according to the NFIB Small Business Optimism Index. “Overall, small business owners are not optimistic about 2023 as sales and business conditions are expected to deteriorate,” said NFIB Chief Economist Bill Dunkelberg. “Owners are managing several economic uncertainties and persistent inflation and they continue to make business and operational changes to compensate.” You can see in the chart below, we are at the lowest levels in nearly a decade.

Despite the overall gloom, there were some positive points in the survey. Inventories are back in balance, which means the supply chain issues of the post-pandemic period are largely in the rear view mirror. The number of companies raising prices also fell, and employers continue to plan to hire more workers.

Generally speaking companies do expect a recession in 2023 and are taking steps to prepare themselves for it.

Minneapolis Fed President Neel Kashkari wrote an article on inflation which discusses what the Fed missed in 2021 and lays out what it might do going forward. His point is that when prices rise, both supply and demand should adjust. Rising prices should decrease demand and increase supply. The problem is that supply hasn’t increased.

He likens it to surge pricing on ride sharing apps. When it rains more people would rather ride than walk. Prices rise. However what happens when every available driver is already working? Supply doesn’t increase. And that is where we are now. In economics terms, the supply curve is vertical. Increased demand just increases prices.

If this sounds familiar to old-timers, they might recognize the term “supply-side economics” from the late 1970s and the Reagan Administration. We had this problem during the 70s, when US manufacturing capacity was more or less maxxed out, and rising demand simply meant higher prices.

Supply side economics incentivized producers to increase capacity, which would address the lack of incremental supply (hence the name “supply-side)” The government cut taxes, which made it more likely that new projects would be profitable (or NPV-positive in B-school jargon) and it also changed the rules on depreciation which allowed companies to recoup capital expenditures quicker through bigger up-front tax deductions. While the term “supply side” has become a pejorative on the left, that was the logic of it.

It is interesting to see guys like Neel Kashkari who were too young to remember the 1970s inflation issues start to think about supply side economics. Global economies have done the Keynesian pump-priming thing for the past 15 years, which was more or less what we did from 1965 – 1980. Similar results. So perhaps a new, re-branded supply-side economics will become in vogue again.

I launched my Substack over the weekend, where I took went over the market’s reaction to the jobs report and the main drivers. The Weekly Tearsheet will take a deeper dive into some of the happenings in the prior week, along with economic commentary. I hope you enjoy it and consider subscribing. If you use this professionally and can expense it, I hope you consider becoming a paid subscriber.

I am accepting ads for this blog as well, if you would like a mention. In addition, if you enjoy the content and would like a white label solution for your company, I would be interested in having a conversation.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.