[ad_1]

Dear Mr. Market:

Finally. It’s here….a bonafide stock market correction. What’s also almost here is Groundhog Day…but more on that in a minute. For those of us with short memories we’ll have to do the necessary preamble and small talk refresher on what this is. For those of you who remember what you did (or were supposed to do/not do) during the last correction, here we go again. Do you remember the fantastic Bill Murray movie “Ground Hog Day”? Click here for the last time we wrote about it but again….people seem to forget what they ate for breakfast so you may not remember what happened in 2018.

Oh… but “it’s different this time“, right? Those are indeed the four most dangerous words in investing. Are there problems to worry about? YES!!!! (but there always has been and always will be)

Our article that we linked to above followed the least volatile year in the history of the stock market. Read that sentence again if you must but for some context just let it sink in. There never was a more docile and boring year than 2017. Not one single month was down and there was zero volatility. Then….all hell broke loose in 2018. December was actually the worst month in 80 years. Why don’t you remember it though? Perhaps it’s partly due to the fact that the last two years has aged us all by what feels like 20 years. It’s also due to the reality that it always feels worse when you’re in it than once it’s passed.

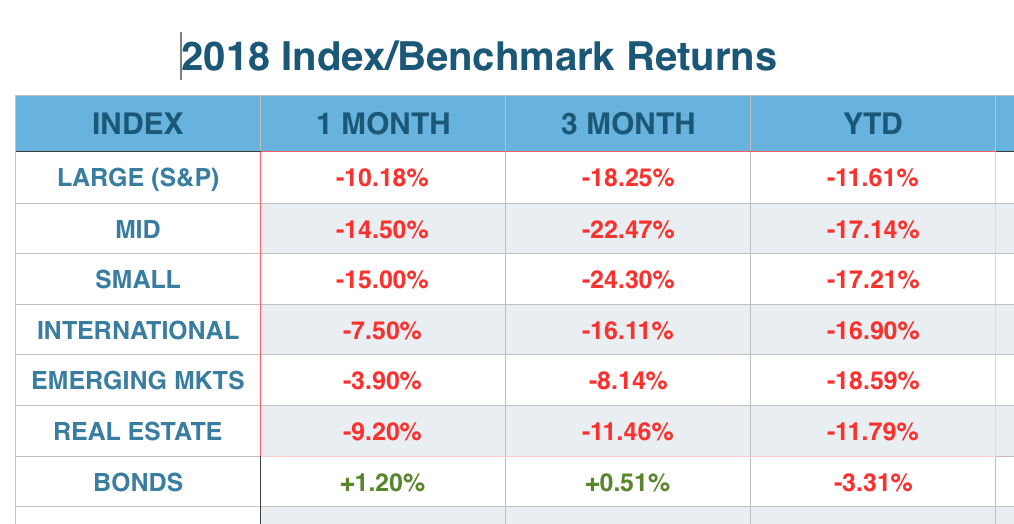

Anyway, 2018 was never called a “bear market” because we didn’t hit the proverbial -20% by definition. Well…at least not for Large Cap stocks (-18%) but Small and Mid Caps dropped -23% and -24%. After that it was off to the races and if you “bought the dip” or simply held on and didn’t panic, you are all the better for it now. Guess what? We’re going to see something very similar right now. Save this article as a time stamp if you don’t believe us or want something to say “I told you it was different this time” and later prove us wrong.

The S&P 500 is trading in the roughly 4,300 point level as of this writing. We believe and are essentially “time stamping” our prediction… that we’ll be at 5,000 or about +16% higher from here within the next year or so. If you just got into the market and are seeing this dip now it’s certainly not comforting but hopefully you have at least a five year time horizon. If you do….you’ll be fine.

Can you imagine if we finally had a down year? Could you handle finishing a year down, say -10%? What if we had two years down? How about three like in the early 2000’s when it happened for the only time in history? Would you hang in there if you knew that the odds of the following year (or 5) were going to be higher? Most people say yes but do not actually DO it. They get rattled and change their allocation because the news feels different. Remember that on average the stock market drops intra-year -14% from peak to trough….every single year. (click here for a refresher on that stat too!) We’ve built an allocation towards gold over the better part of the past year for exactly this situation. It has done zilch (and actually went down for much of the time) except for right now…

Why have we patiently held on to Gold over the past few quarters? Here’s how it’s done versus the S&P 500 as of late:

5 days +1.9% vs -5.7%

1 month +1.8% vs -8.4%

3 months +2.5% vs -4.9%

6 months +2.1% vs -2.0%

Lastly, let us leave you with this simple summation of what we think will happen. The market will get worse in the near-term. It won’t feel good at all to those who are fully invested. Hopefully you do indeed have some gold as we’ve been barking about for the past 18 months. Watch gold not only hang in there for you but expect to see it break out from being range bound in the $1,700-$1,800 range to $2,100 and possibly higher. Once that happens and the correction begins to subside, nibble back with proceeds from your gold (or bonds) and buy back stocks! With regard to the latter part of this year you’ll then most likely see a final “melt-up” in the stock market. What does that mean? It means that although the world is not perfect and there are plenty of emotionally driven and negative selling narratives (some real and some amplified), we’ll be higher on the stock market from here. Two years from now there will be less of a supply chain glut/disaster and an economy that doesn’t have one hand tied behind its back. When the S&P 500 hits 5,000 plus… you’ll have wished that you either hung in there or bought more at these levels.

[ad_2]

Image and article originally from dearmrmarket.com. Read the original article here.