Vital Statistics:

| Last | Change | |

| S&P futures | 3,873 | -33.75 |

| Oil (WTI) | 79.16 | 0.84 |

| 10 year government bond yield | 3.67% | |

| 30 year fixed rate mortgage | 6.38% |

Stocks are lower this morning on no real news. Bonds and MBS are down small.

Third quarter GDP was revised upward from 2.9% to 3.2%, according to the BEA. The revision was driven primarily by an upward adjustment to consumer spending, primarily in services. The PCE price index was revised upward by 0.1% to 4.8%. The PCE price index (ex-food and energy) was revised upward by 0.1% as well.

The Atlanta Fed’s GDP Now model sees 2.7% GDP growth in Q4.

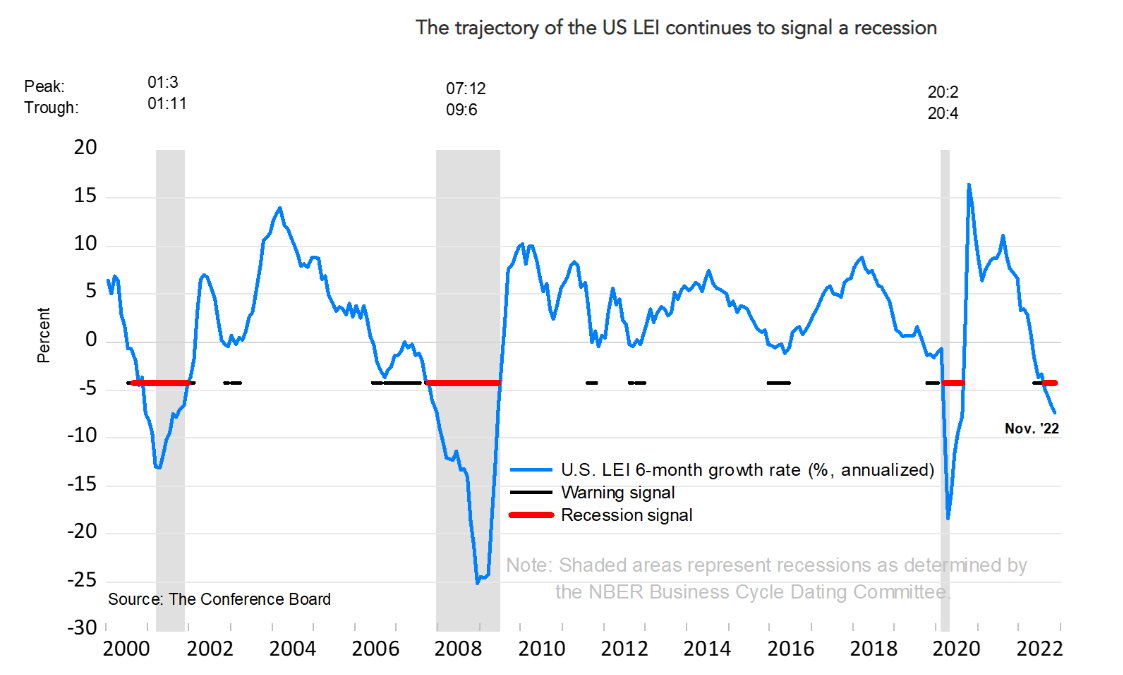

The index of leading economic indicators declined sharply in November, according to the Conference Board. “The US LEI fell sharply in November, continuing the slide it’s been on for most of 2022 after peaking in February,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “Only stock prices contributed positively to the US LEI in November. Labor market, manufacturing, and housing indicators all weakened—reflecting serious headwinds to economic growth. Interest rate spread and manufacturing new orders components were essentially unchanged in November, confirming a lack of economic growth momentum in the near term. Despite the current resilience of the labor market—as revealed by the US CEI in November—and consumer confidence improving in December, the US LEI suggests the Federal Reserve’s monetary tightening cycle is curtailing aspects of economic activity, especially housing. As a result, we project a US recession is likely to start around the beginning of 2023 and last through mid-year.”

Purchase application payments (a proxy for mortgage affordability) fell slightly in November as mortgage rates fell. The national median mortgage payment fell from $2,012 to $1,977. The MBA attributed this to a slowing in home price appreciation and a 26 basis point decrease in the mortgage rate.

It is important to understand that affordability is more than just the mortgage payment – it is also a function of incomes. Since incomes are rising at the fastest rate in decades that helps blunt the impact of rising payments. Last October / November almost certainly will be the peak of unaffordability as rates continue to fall and home price appreciation slows. As Keynes discussed about “sticky wages” they generally won’t fall, so higher incomes are baked into the cake already. Falling rates and prices will square the circle.