[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,864 | -12.75 |

| Oil (WTI) | 74.32 | 1.48 |

| 10 year government bond yield | 3.75% | |

| 30 year fixed rate mortgage | 6.46% |

Stocks are lower after stronger-than-expected labor market data. Bonds and MBS are down.

The economy added 235,000 jobs in December, according to ADP. This was above the 145,000 Street estimate, and is also above the forecast for tomorrow’s jobs report. Initial Jobless claims fell to 204,000 which signals the labor market remains tight. Finally, outplacement firm Challenger, Gray and Christmas noted 43,651 announced job cuts in in December.

The minutes from the FOMC meeting were released yesterday and they poured cold water on people hoping for a Fed pivot.

What about the dovish CPI reports in November and December? “Participants concurred that the inflation data received for October and November showed welcome reductions in the monthly pace of price increases, but they stressed that it would take substantially more evidence of progress to be confident that inflation was on a sustained downward path. Participants noted that core goods prices declined in the October and November CPI data, consistent with easing supply bottlenecks…. Participants noted that, in the latest inflation data, the pace of increase for prices of core services excluding shelter—which represents the largest component of core PCE price inflation—was high. They also remarked that this component of inflation has tended to be closely linked to nominal wage growth and therefore would likely remain persistently elevated if the labor market remained very tight.”

In other words, the reduction in inflation is being driven primarily by easing supply chain issues which is old news. They see inflation as being driven by supply chain issues, housing, and wages. The supply chain issues are largely resolved. Housing-driven inflation will disappear by summer. The battle they are fighting is based on wages. As long as wage growth remains high, they are going to keep tightening. Below is a chart of average hourly earnings. We are in the low 5% range. They probably want to see that number closer to 3%. BTW the spikes up and down in the early days of COVID are lockdown-related noise.

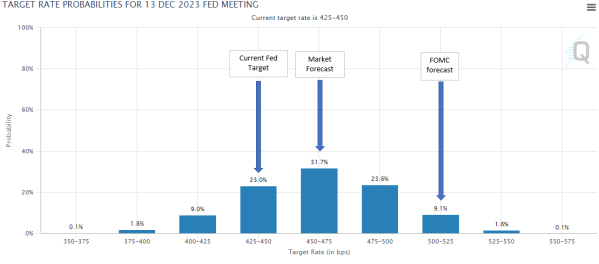

The FOMC also noted that the Fed Funds futures were at odds with the FOMC, and that no members thought it would make sense for the Fed to start easing in 2023. Take a look below at the Fed Funds futures – the disconnect is pretty substantial:

The Fed also noted that financial conditions have eased, and that they don’t want a further easing. “Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee’s reaction function, would complicate the Committee’s effort to restore price stability.”

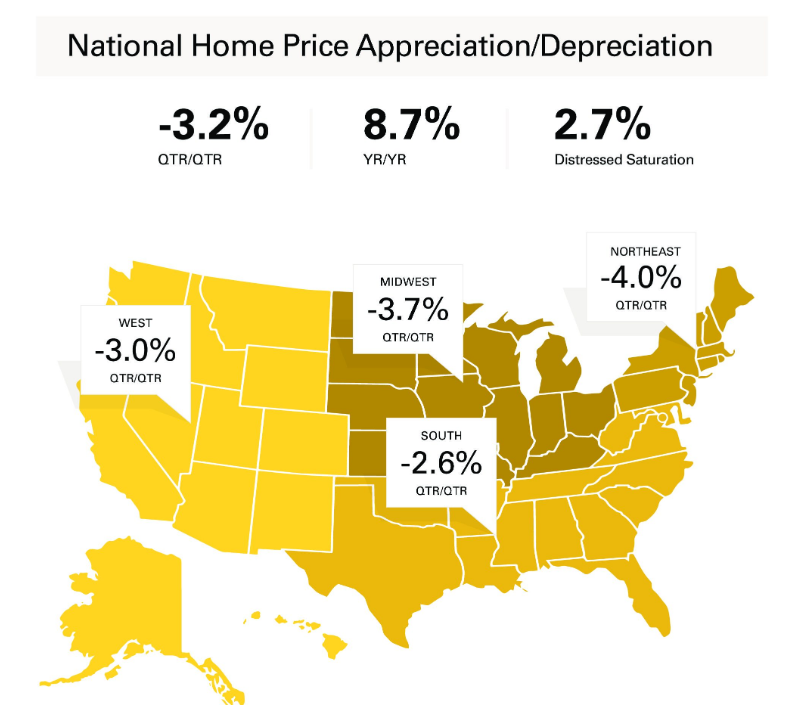

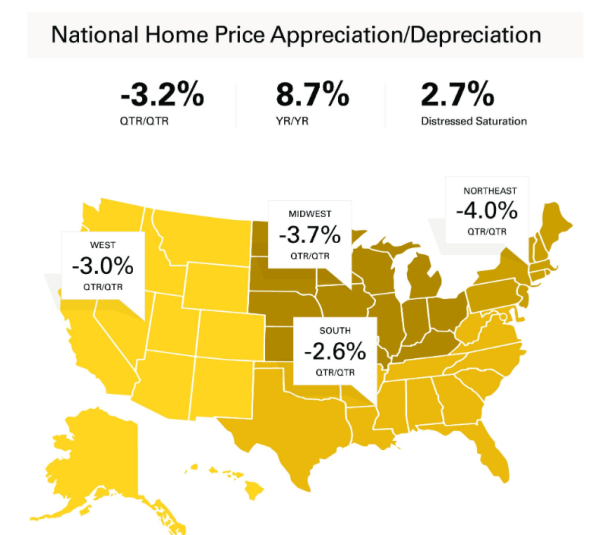

Home prices declined 3.2% on a QOQ basis, according to the Clear Capital Home Data Index. We are beginning to see big declines out West, and MSAs like San Francisco are now flat on a YOY basis. Florida remains one of the best markets.

Finally, on a personal note. I have left Ark Mortgage and am looking for a new opportunity. Any leads for a senior financial / cap markets position will be appreciated. Also, I will begin accepting advertisements on the blog. Please reach out to nyitray@hotmail.com if you would like a mention. If you would like some financial content for your company as a marketing tool, please reach out – I already do some of that.

I plan on launching a Substack as well, where I will do a weekly deeper dive on things going on in the economy or current events. More info to follow.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.