[ad_1]

From the just-completed month

June Numbers

- Tweets posted on our Private Member Twitter: 177

- Updates and Special Reports posted on the Member site: 8

Peter’s thoughts on the finished week and the week ahead | Issued most weekends

Commentary

There are times when break-even trading is about the best I can expect. I am OK with break-even trading. Treading water is way better than sinking. No matter if the markets are difficult or if I am making them difficult, if I can keep my capital intact eventually things will get back on track. Five of the last seven tranches I have closed have been for a loss. Over the years I have learned (sometimes reluctantly) to have patience for better times. Over-eagerness to get trading back on track can lead much deeper into a drawdown.

U.S. Dollar Index | June 12th report

The USDX is taking another attempt at the upper boundary of a massive rectangle. If this rectangle is completed, I will look for an opportunity to go long.

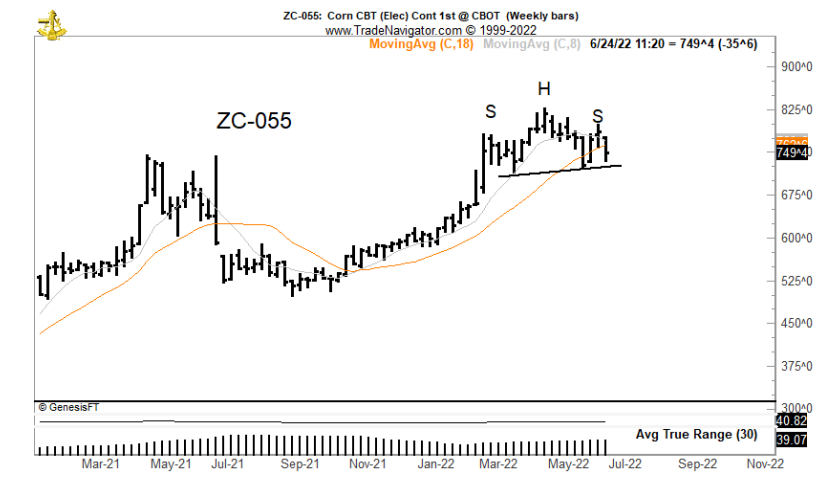

Corn | June 26th Report

The weekly continuation chart displays a clear possible H&S top, but the same pattern does not appear in the New Crop contracts. I will review the shorting opportunities in the Dec contract if and when the weekly chart H&S is completed.

Members receive:

- Trading Commodity Futures with Classical Chart Patterns: A free PDF copy of Peter’s classic out-of-print book

- The Weekend: Thoughts on a Sunday (Weekend) Afternoon

- The Monthly: Issued monthly, will provide an overview of the completed month and highlighted member content

- Private Twitter Page: Real-time alerts on interesting charts and observations, member dialog, the process of trading, the human aspect of trading, and risk/trade management (streamed on the member site as well)

- Webinars: Periodic member-only webinars where Peter speaks about current conditions and fields member questions

- Knowledge Center: Fast and easy access to current and archived content from Peter’s extensive library of trading content

- Automatic notifications: Email and social media notifications are sent out when new content is published

- Factor Report Educational Papers: Periodic educational and instructional documents

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. My goal is to shoot straight on what trading is all about.

I hope you will consider joining the Factor community.

[ad_2]

Image and article originally from www.peterlbrandt.com. Read the original article here.