[ad_1]

- On Friday, the price of gold formed its four-month high at the $1,772 level.

- During the Asian trading session, the price of silver fell by 1.10% since the beginning of trading last night

Gold chart analysis

On Friday, the price of gold formed its four-month high at the $1,772 level. Since then, the price has been retreating, and today’s low is at the $1752 level. The current price is the $1756 level, and based on today’s picture, we could expect a further pullback in the price of gold. We need a negative consolidation to drop below the $1750 level for a bearish option. Then we need to stay down there and, with a new bearish impulse, continue to pull back the price.

Potential lower targets are $1740, $1730, and $1720 support levels. For a bullish option, we need a positive consolidation and a return to the 1770 resistance level. Then we need a break above and try to hold above. With the next bullish impulse, we could expect further growth in the price of gold. Potential higher targets are $1780 and $1790 levels.

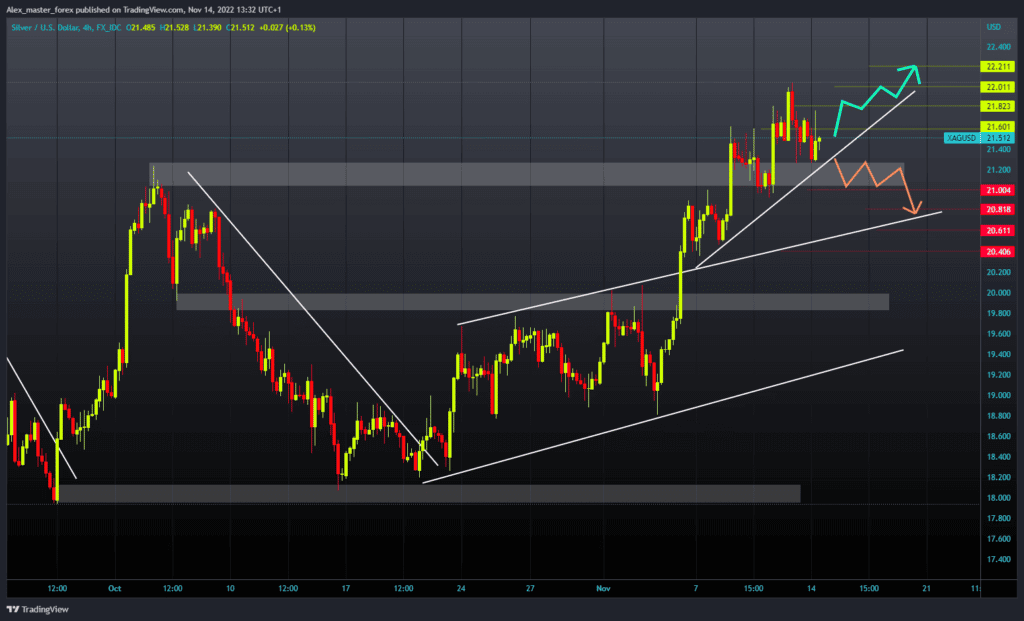

Silver chart analysis

During the Asian trading session, the price of silver fell by 1.10% since the beginning of trading last night. This morning’s low was at the $21.20 level. We see a pullback from last week’s high at the $22.00 level. For a bearish option, we need a negative consolidation and a further pullback to the $21.00 level.

A break below would put further pressure on the price of silver, and we could see a continuation of the price decline. Potential lower targets are the $20.80 and $20.60 levels. For a bullish option, we need a positive consolidation and price return to the $22.00 level. After that, we need a break above and try to hold on above. Potential higher targets are the $22.20 and $22.40 levels.

BONUS VIDEO: Weekly news summary from the markets

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.