Vital Statistics:

| Last | Change | |

| S&P futures | 4,054 | -21.25 |

| Oil (WTI) | 82.44 | 2.43 |

| 10 year government bond yield | 3.56% | |

| 30 year fixed rate mortgage | 6.37% |

Stocks are lower as markets continue to digest Friday’s jobs report. The strong wage growth number was a subject of discussion over the weekend in the business press. Bonds and MBS are down.

The upcoming week should be relatively uneventful as we have little economic data and the Fed is in the quiet period ahead of next week’s FOMC meeting. We will get productivity and unit labor costs on Wednesday, but that is the second revision for the third quarter and probably too far in the past to matter much for monetary policy. We will get the University of Michigan Consumer Sentiment number on Friday, which will include inflationary expectations.

The services economy improved in November, according to the ISM Services Index. The Business Activity component increased by 9 points, which is bullish for the economy. Supply chain issues continue to abate. Prices continue to be firm, although the number of firms reporting increased prices did decrease slightly.

While the manufacturing economy seems to be in contraction, the services economy is getting better. I suspect that the US dollar’s strength is playing a part, and as the Fed wraps up its tightening regime the dollar will weaken.

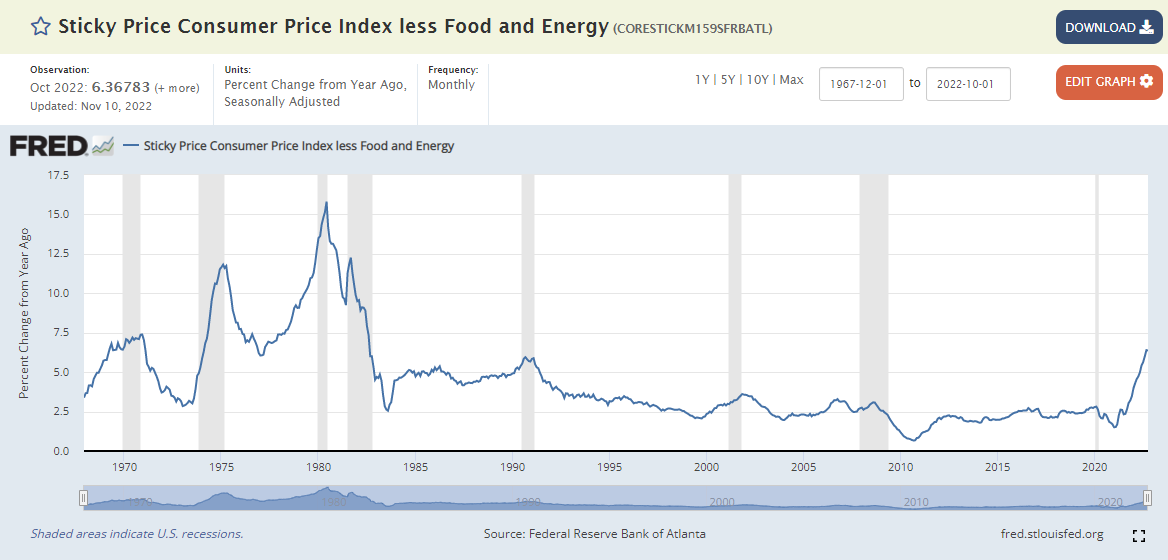

Dr. Cowbell argued over the weekend that the Fed’s inflation target should be 3%, not the 2%. FWIW, in the 1980s and 1990s, inflation was much higher than the 2% target, and I think most people remember that as a pretty comfortable period economically.