[ad_1]

Dear Mr. Market:

We’ll open this letter to our friend “Mr. Market” by stating one thing that will be very obvious in six to 12 months. 90% of people reading this article will have gotten it wrong. It’s not your fault though…it’s the way our minds are wired and the content we’re constantly being fed.

Regardless of your current market strategy it’s times like this that will test the most patient of long-term investors. We’ve written about this countless times but no matter what the sage counsel or stock market adage is, you should be rattled right now. We could be like most “perma-bull” financial advisors and try to data mine for all the reasons to stay calm or share positive anecdotes to convince you that now is the time to invest; it won’t matter though. Putting “lipstick on a pig” won’t help you nor the current market environment. Bad news and reasons to panic will be the headline for the weeks to come and there will seemingly be no safe place to hide.

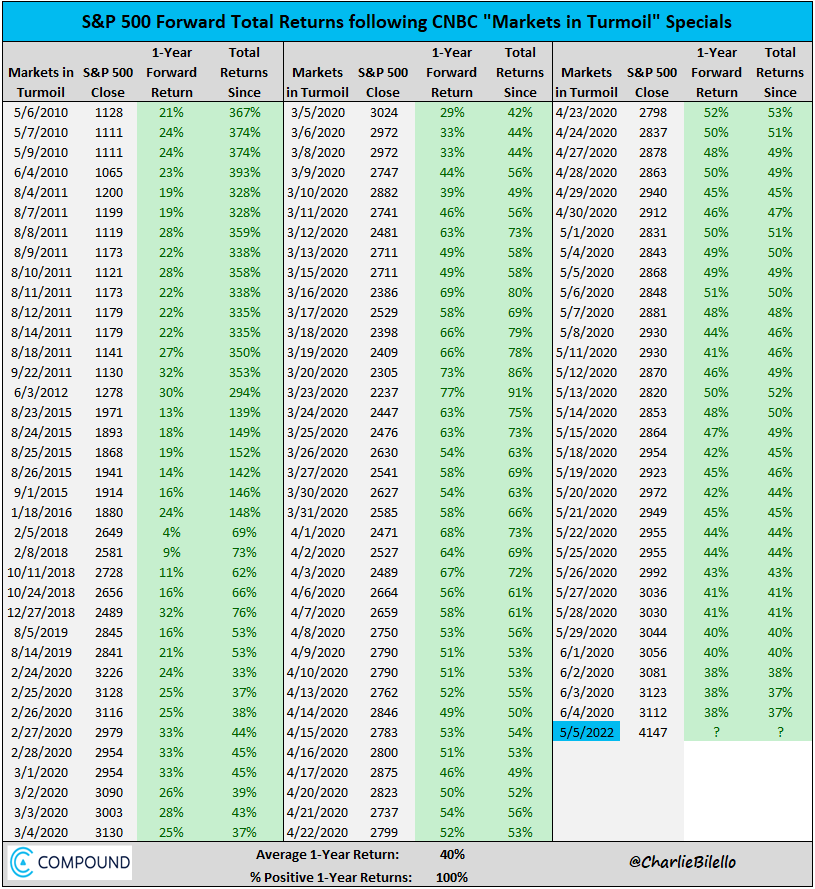

Case in point, last week CNBC put out a segment that drew tons of eyeballs. The last time they aired a similar piece about “markets in turmoil” was September of 2018 and by December the markets bottomed out and then rallied. This observation is not to insinuate that we’re going to instantly rally but rather that we’re indeed getting close to some form of market capitulation. We wrote about capitulation just two years ago in this article. Click here for a quick refresher. Fear always sells and garners more attention than it should. People tend to forget this phenomena and that no matter what, the same movie plays out again. “It’s always darkest right before dawn”. Are we getting close? Perhaps so, but in our opinion we’re going to see a bit more near-term pain and drawdown before things settle as the pendulum then swings back the other way.

The above complication of data points based on when CNBC has aired similar “markets in turmoil” announcements points to the only market indicator with a perfect record. In every single instance the market was substantially higher 1-year later. Will it be different this time?

Simply put…. We doubt it.

Most investors reading this may recall going through a bear market but when was the last time someone went to cash to ride it out with the seemingly smart idea to get back in once things settled down? Over the past 25 years we have had a handful of clients want to run to safety and then have us notify them to get back in when things looked better. How did that work out? It didn’t…and it won’t this time either. That may not negate the pain of opening up account statements right now or in the months to come, but it should be noted that when the markets do recover, not if… it will be impossible to catch the bulk of the recovery. At that point it still will not feel right or indeed safe to get back in. Timing the market has constantly been proven to be a futile game and not a single person in history has ever nailed it. You not only have to figure out the proper exit but more difficult and elusive is the point of re-entry. Five years from now there will be a handful of people who got out at the right time only to regrettably realize that they never got back in and everything is higher.

It’s simply a known fact to us that almost every investor using the “buy and hold strategy” only gets the first part right. What unfortunately happens is staying strong and resilient on the second part is the truly tough piece of the puzzle. Is there a recession coming? That’s a question we get often and the answer may sound snarky but it’s that there always is a recession on the horizon. We just saw the first negative quarter of GDP growth so technically we’re only one quarter away from that technical definition of the next official recession coming to fruition. That fact, however, does not mean that the sky is falling or that life will end this quarter. It just means that it’s part of an economic cycle and stocks don’t go up in stair step fashion. The stock market is beyond frustrating at times. It seems to “take stairs up and the elevator down” but over time it will be higher than where it is now.

Lastly, as far as recessions and market predictions go, we do indeed think we’ll be higher once the dust settles. That whole process will take time and while we advise staying the course, just know that it won’t feel right along the way. Speaking of economics, recessions, and stock market targets, we leave you with this recent piece from our favorite economist. Please click here for a more in depth review of that and in the meantime, please do your best to remain calm and allow your strategy to play out instead of the headlines or emotions dictating your next move.

[ad_2]

Image and article originally from dearmrmarket.com. Read the original article here.