[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,982 | -16.25 |

| Oil (WTI) | 85.21 | -1.72 |

| 10 year government bond yield | 3.72% | |

| 30 year fixed rate mortgage | 6.62% |

Stocks are lower this morning on no real news. Bonds and MBS are up

Retail Sales surprised to the upside in October, rising 1.3% month-over-month and 8.35 year-over-year. The Street was looking for a 1% increase. Ex-vehicles and gas, sales rose 0.9%. These numbers are nominal (not inflation-adjusted), so the year-over-year increases are more or less flat.

Mortgage applications rose for the first time in 2 months last week as rates fell. Overall applications increased by 2.7% as purchases rose 4% and refis fell 2%. The refi index is 88% lower than it was a year ago. The purchase index is 46% lower than a year ago. “Mortgage rates decreased last week as signs of slower inflation pushed Treasury yields lower,” said Joel Kan, MBA Vice President and Deputy Chief Economist. “The 30-year fixed rate saw the largest single-week decline since July, dropping to 6.9 percent. Application activity, adjusted to account for the Veterans Day holiday, increased in response to the drop in rates – driven by a 4 percent rise in home purchase applications. Purchase applications increased for all loan types, and the average purchase loan dipped to its smallest amount since January 2021. Refinance activity remained depressed, down 88 percent over the year. There is very little refinance incentive with rates so much higher than last year.”

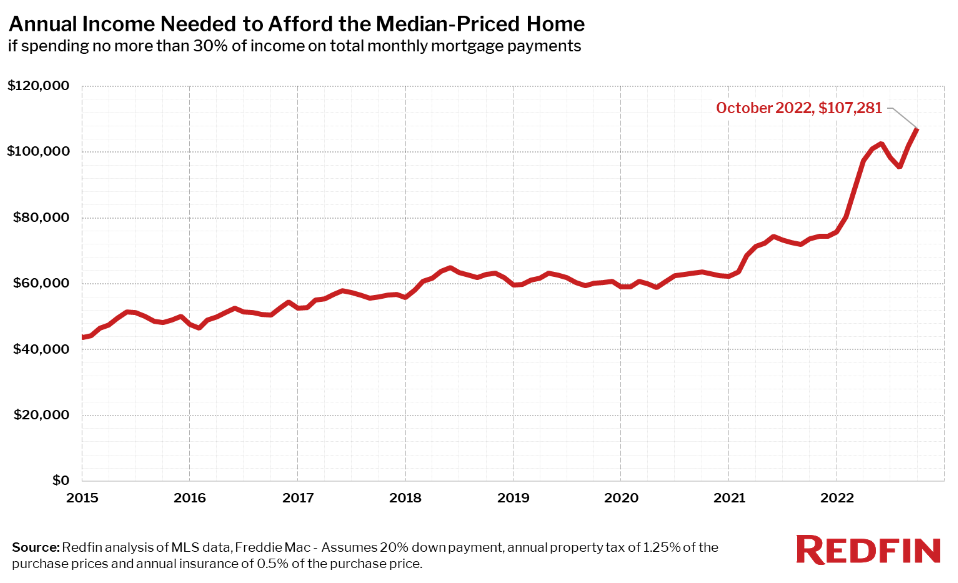

Housing affordability has declined over the past year, and the typical homebuyer needs to make six figures to afford the typical home, according to a study from Redfin.

The median household income in the US is $70,784 which means most households are shut out of the purchase market. Some of the hottest markets like San Francisco now require a salary over $400k.

People selling out of expensive California MSAs have pushed up prices in places like Boise or other Western MSAs. As homes in California become harder to sell (just less potential buyers) there are less out-of-MSA buyers in these places, and home prices are re-adjusting to what the locals can afford.

Homebuilder sentiment fell again, according to the NAHB Housing Market Index. “Higher interest rates have significantly weakened demand for new homes as buyer traffic is becoming increasingly scarce,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “With the housing sector in a recession, the Biden administration and new Congress must turn their focus to policies that lower the cost of building and allow the nation’s home builders to expand housing production.”

The current reading of 33 is the lowest since mid-2012, when the post-bubble housing market was bottoming.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.