- The price of gold fell to a new two-year low at the $1,620 level late last night.

- During the Asian trading session, the price of silver formed its three-week lower low at the $18.35 level.

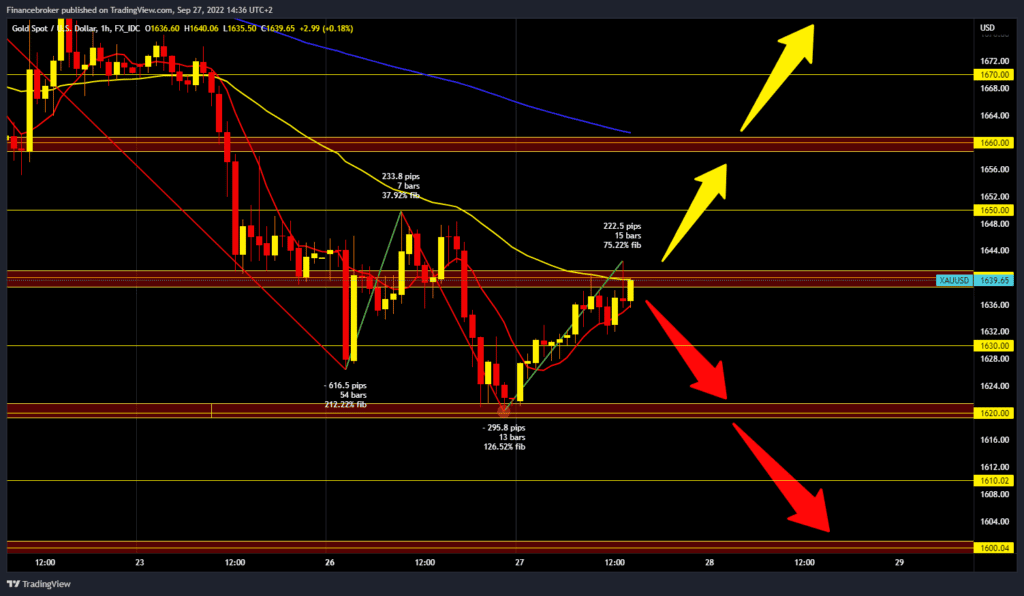

Gold chart analysis

The price of gold fell to a new two-year low at the $1,620 level late last night. Gold began to recover during the Asian trading session, and we are now at the $1640 level. If we were to rise to $1660, we would form a new higher high and thus confirm a potential recovery. Additional resistance at that level is in the MA200 moving average. It is also vital for us to stay around $1650 for a while and form a new bottom there in order to strengthen the support. For a bearish option, we need a new negative consolidation. Then the price would turn towards lower support levels. We would probably retest the previous low at the $1620 level. Potential lower targets are $1610 and $1600 levels.

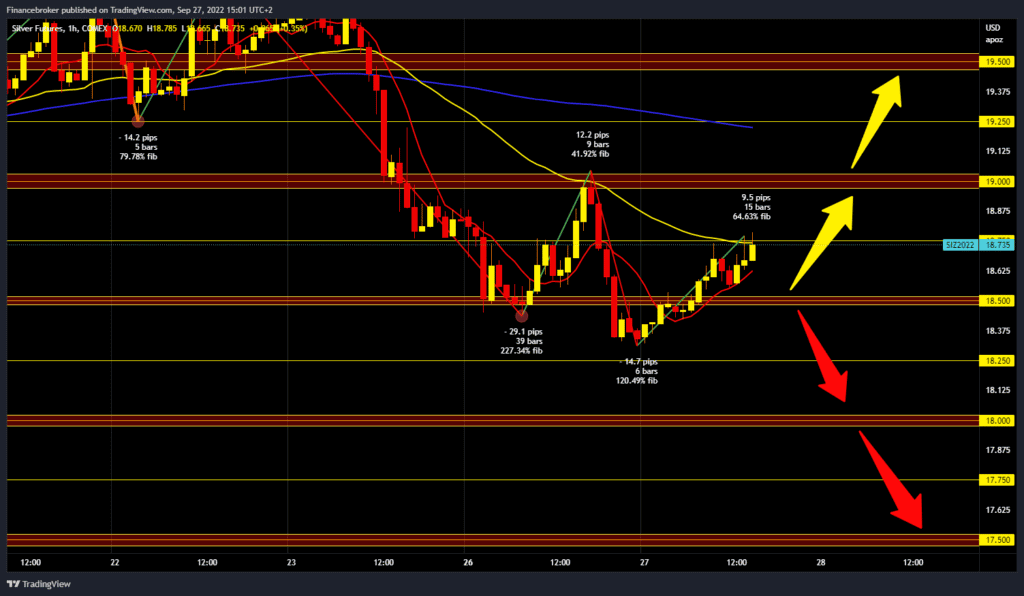

Silver chart analysis

During the Asian trading session, the price of silver formed its three-week lower low at the $18.35 level. Then we managed to stabilize at that level and, with a new bullish impulse, move up to the $18.75 level. The potential resistance at that level is in the MA50 moving average, and we need a break above it to continue the recovery. Our next target is yesterday’s high at the $19.00 level. If we managed to move above it, we would form a new higher high, and the target is at the $19.25 level. Additional resistance in that zone is the MA200 moving average. We need a new negative and a price drop below the $18.50 level for a bearish option. After that, we could once again test the $18.35 this morning low. Potential lower targets are $18.25 and $18.50 levels.

BONUS VIDEO: Weekly news summary from the markets

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.