[ad_1]

On 2/21/2022, Frank emailed me about our 10-Delta ultra-low-risk cash-secured put strategy. With Moderna Inc. (MRNA) trading at $145.00 per-share, he asked about using the deep out-of-the-money $118.00 weekly strike that expired on 2/25/2022. Let’s evaluate this trade to see if it aligns with our strategy goals and personal risk-tolerance.

MRNA option-chain on 2/21/2022

MRNA Weekly Put Option-Chain on 2/21/2022

The 10-Delta requirement is met by the $118.00 strike (-0.992) and shows a bid-ask spread of $1.23 – $1.53. This is definitely a negotiable price but, for purposes of this article, we will use worst case scenario of $1.23 (published bid price).

Factor #1: Expectations of lower returns than normal: Monday is President’s Day creating a 4-day week

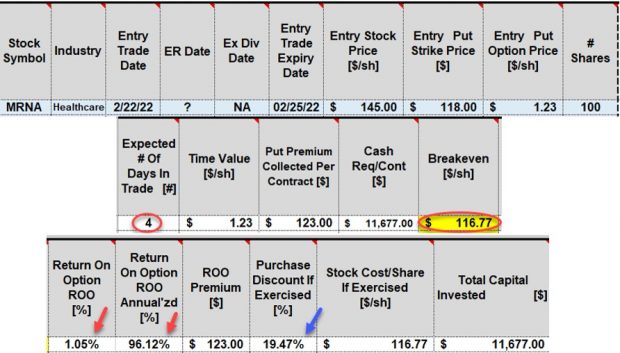

Let’s feed the option-chain data into the BCI Trade Management Calculator (TMC) to see if the initial returns meet our stated goals (let’s say 0.5% per-week, 26% annualized as a reasonable hypothetical):

MRNA: 10-Delta Put Calculations

The spreadsheet shows a 4-day return of 1.05%, 96.12% annualized (red arrows) with a breakeven price point of $116.77. If the option is exercised, MRNA would be purchased at a 19.47% discount from the price when the trade was initiated (blue arrow). This is certainly not lower-than-expected returns but, in fact, much higher. What is causing this skew in expected returns? Why is the implied volatility of MRNA so high this particular week?

You guessed it …earnings will be announced this week

MRNA Upcoming Earnings Report

Discussion

When selecting strikes for our 10-Delta ultra-low-risk put strategy, in addition to the 10-Delta requirement, we must also ensure the time-value returns meet our previously stated goal range. When the return is surprisingly high, we must check what event is causing this rise in expected implied volatility. In a majority of these instances, the cause is an upcoming earnings release and the trade should be avoided until after the report passes.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan,

Thank you so much for all the content you make.

My husband and I have been following you for the past eight years and have finally started covered call writing. We also just signed up for your monthly VIP, finished your Investing for Students textbook & ordered the Covered Call Encyclopedia.

Thank you again for all you do!

Sincerely,

Cheryl & Ryan

Upcoming event

Money Show Orlando live event

October 30th – November 1st, 2022

OMNI ORLANDO RESORT AT CHAMPIONSGATE

Visit Alan, Barry and members of the BCI team at Booth # 415

Sunday, October 30, 2022, at 5:00 pm – 5:45 pm EDT

Covered Call Writing: Multiple Applications Based on Current Market Conditions

Monday, October 31, 2022, at 4:30 pm – 6:30 pm EDT

Selling Cash-Secured Puts: Detailed Start-to-Finish Six-Part Program*

Masters Class

Comprehensive Course on Selling Cash-Secured Puts

Detailed start-to-finish 6-part program

This presentation will provide all the information, with real-life examples, necessary to master the strategy of selling cash-secured puts. The program is divided into 6 sections:

- Section I:

- Section II

- Section III

- Section IV

- Section V

- Ultra-low-risk put/Delta strategy

- Section VI

This presentation was developed to benefit both beginner and experienced option traders and will provide all the information needed to initiate the strategy and elevate returns to the highest possible levels.

45-minute presentation

Covered Call Writing: Multiple Applications Based on Current Market Conditions

Real-life examples with Invesco QQQ Trust (Nasdaq: QQQ)

Covered call writing is a low-risk option-selling strategy geared to generating cash flow with capital preservation a key requirement. This presentation will demonstrate how the strategy can be crafted to benefit in all market environments. Market situations highlighted are:

- Normal to bull markets

- Bear and volatile markets

- Low interest-rate environments

A popular large-cap technology exchange-traded fund, Invesco QQQ Trust, will be used to establish rules and guidelines to benefit in these market circumstances.

Registration link and more details to follow.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

[ad_2]

Image and article originally from www.thebluecollarinvestor.com. Read the original article here.