[ad_1]

- The price of gold formed a new high this morning at the $1712 level.

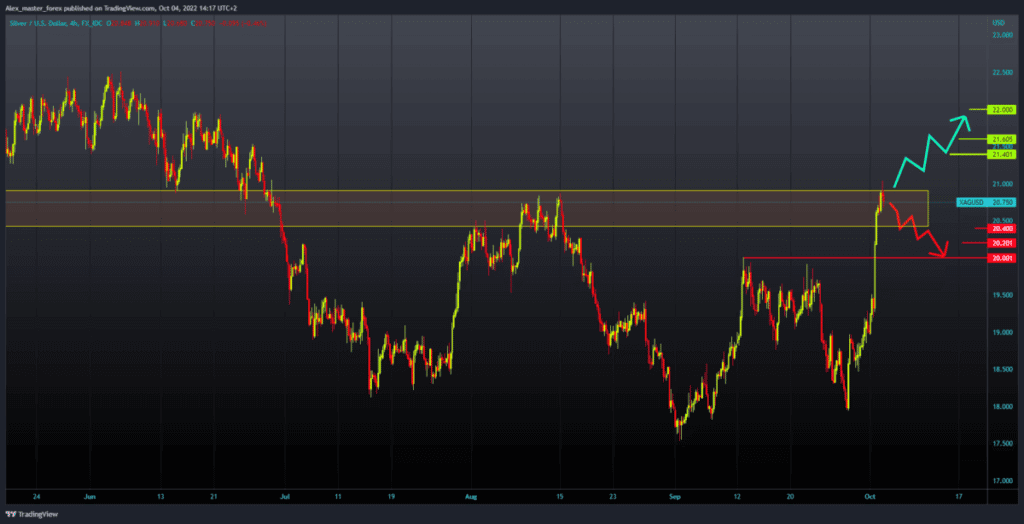

- Silver price made a great jump in the last week from $17.95 to $21.00 level.

- The Bank of England’s willingness to buy up to £5 billion of long-term gilts is dragging US bond yields off multi-year highs and continuing to weigh on the dollar.

Gold chart analysis

The price of gold formed a new high this morning at the $1712 level. Gold is currently meeting resistance at the 50.0% Fibonacci level, and we could see a smaller drop to $1690 at the 38.2% Fibonacci level. To continue the bearish option, we need a negative consolidation and a further pullback in the price of gold. First, we could have possible support at the $1680 level. If we fail to maintain that level, the gold price will continue to fall. Potential lower targets are $1670 and $1660 levels. For a bullish option, we need a continuation of positive consolidation and a move above 78.6% Fibonacci. Then we need to stay above and continue the recovery of the gold price with a new bullish impulse. Potential higher targets are $1720 and $1730 levels.

Silver chart analysis

Silver price made a great jump in the last week from $17.95 to $21.00 level. Now we see that this bullish impulse has stopped, and we have a minor pullback to the $20.78 level. In August, the price of silver tried to break above, but that attempt ended in failure. Today we made a break, and we need a positive consolidation to keep us here. The silver price also benefits from the dollar index’s current pullback from its multi-decade highs. Based on that, the price of silver could continue up to the $22.00 level, and the last time we were there was at the beginning of June. We need negative consolidation and price pullback to lower support levels for a bearish option. Potential targets are $20.50, $20.20 and $20.00 levels.

Market Overview

The Bank of England’s willingness to buy up to £5 billion of long-term gilts is dragging US bond yields off multi-year highs and continuing to weigh on the dollar. In addition, growing concerns about a deeper economic downturn in the US and Europe offer additional support for gold. Fears were further fueled by disappointing US data on Monday, which showed manufacturing activity contracted in September.

BONUS VIDEO: Weekly news summary from the markets

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.