Vital Statistics:

| Last | Change | |

| S&P futures | 3,668 | -6.50 |

| Oil (WTI) | 84.94 | 0.39 |

| 10 year government bond yield | 4.31% | |

| 30 year fixed rate mortgage | 7.10% |

Stocks are lower this morning as global rates continue to rise. Bonds and MBS are down.

The resignation of Liz Truss doesn’t seem to have had an impact on UK assets, as the pound and gilts continue to drop. The pain in gilts is spilling over into other sovereign debt with Treasury yields briefly hit 4.34% this morning.

The CFPB’s funding arrangement has been ruled unconstitutional, according to a Federal Appeals Court. Elizabeth Warren’s idea for the CFPB was to have it funded by the Federal Reserve, which is outside the purview of Congress. This would make it impossible for Congress to cut its funding. This potentially could vacate some rulings the Bureau has made in the past. I don’t think there is anything that would affect the mortgage business, however. I believe the actual litigation in question concerns payday lenders.

The Fed Funds futures have been inching upwards. A 75 basis point hike in two weeks is more or less a lock, and the December futures have a 60% chance for another 75 basis points and 40% for only 50. They are then looking at another 25 bps in February, which will put the Fed Funds rate at a range of 4.75% – 5%, where they pretty much remain for the rest of 2023.

Note that a month ago, a target rate of 4.5% – 4.75% wasn’t even considered.

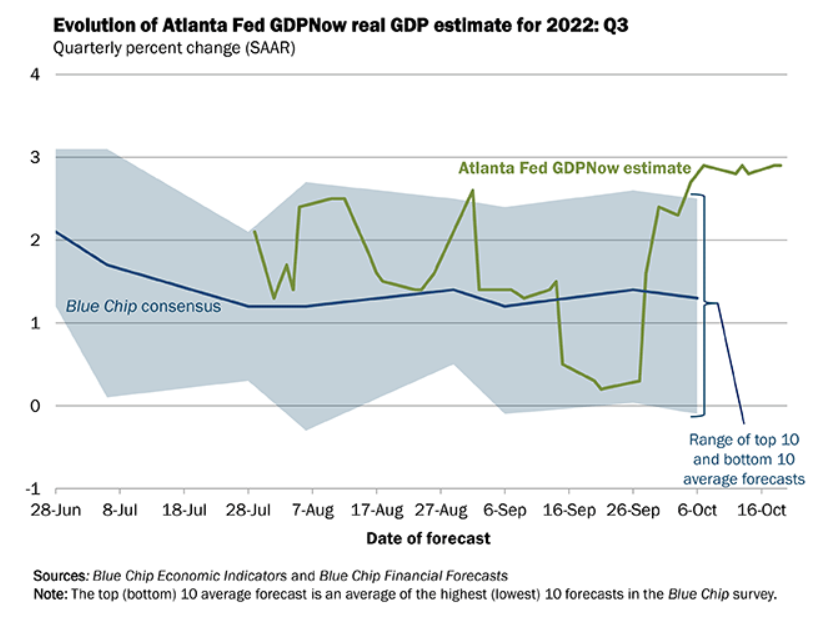

Since monetary policy acts with a lag, the string of 75 basis point hikes starting in June, the economic impact of this has barely begun to hit. The Atlanta Fed’s GDP Now index sees 2.9% in Q3, which seems optimistic, given that one strong retail sales print caused them to revise upward that number from about 0.5% to 2.5%.

I find it hard to believe that we see a massive growth acceleration in the midst of a tightening cycle, but that is what their models are saying.