Vital Statistics:

| Last | Change | |

| S&P futures | 3,855 | 16.25 |

| Oil (WTI) | 89.30 | 1.38 |

| 10 year government bond yield | 3.97% | |

| 30 year fixed rate mortgage | 7.00% |

Stocks are higher this morning after the GDP report. Bonds and MBS are up as well.

The advance estimate for third quarter GDP came in at 2.6%, an uptick from the 0.6% decline in the second quarter. The increase was driven by an uptick in consumption as well as government spending. Housing was a drag. Trade was also a positive contributor as exports increased and imports decreased. Personal consumption expenditures rose 1.4%. Both numbers were better than expected, which put a bid under stocks.

The report contained some good news on inflation. The PCE price index rose 4.2% compared to an increase of 7.3% in the second quarter. Ex-food and energy, the PCE index rose 4.5% compared to 4.7% in the second quarter. The inflation news pushed the 10 year bond yield back below 4%.

In other economic data, durable goods orders rose 0.4%, which was below expectations. Ex-transportation they fell 0.5%. Core capital goods (a proxy for business capital investment) also declined. Initial jobless claims ticked up marginally to 217k, which is historically a very low number.

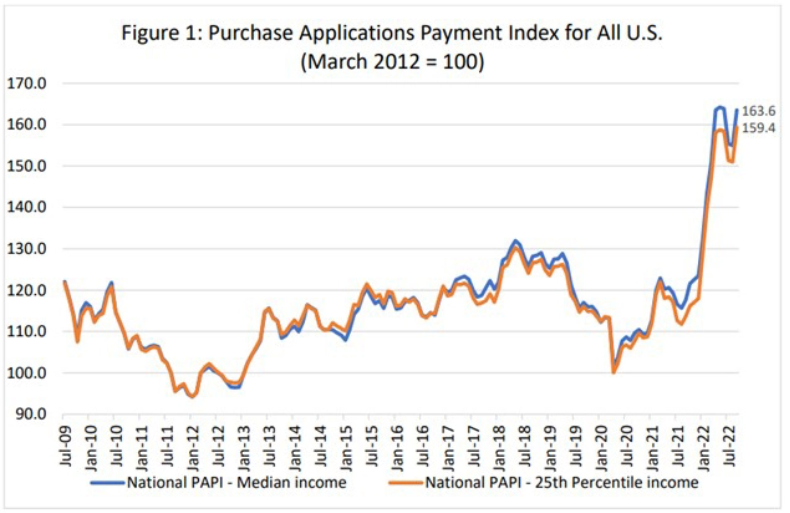

Homebuyer affordability declined in September, according to the MBA. “Homebuyer affordability took an enormous hit in September, with the 75-basis-point jump in mortgage rates leading to the typical homebuyer’s monthly payment rising $102 from August,” said Edward Seiler, MBA Associate Vice President of Housing Economics, and Executive Director with Research Institute for Housing America. “With mortgage rates continuing to rise, the purchasing power of borrowers is shrinking. The median loan amount in September was $305,550 – much lower than the February peak of $340,000.”

New home sales continue to decline. In September, new home sales came in at 603,000, which was a decline of 10.9% compared to August and 17.6% from a year ago.