Vital Statistics:

| Last | Change | |

| S&P futures | 3,755 | -52.15 |

| Oil (WTI) | 94.76 | -1.58 |

| 10 year government bond yield | 2.97% | |

| 30 year fixed rate mortgage | 5.78% |

Stocks are lower this morning as the banks kick off earning season. Bonds and MBS are flat.

JP Morgan reported earnings that missed Street expectations. Earnings per share fell 27% YOY as provisions for loan losses and noninterest expense increased. Mortgage banking revenue fell 14% QOQ and 27% YOY as lower production revenue was offset somewhat by higher servicing income. Origination volumes fell 11% QOQ and 45% YOY to $21.9 billion. The stock is down about 3% pre-open.

The producer price index came in hotter than expected, rising 1.1% on a MOM basis and 11.3% on a YOY basis. The PPI focuses on inflation at the wholesale level, which will translate into higher prices at the consumer level down the road. About half of the increase was attributable to gasoline prices, which thankfully are beginning to fall. Final demand when you strip out food and energy rose 0.4% MOM and 8.2% YOY.

The strength of the dollar is beginning to help in the fight against inflation as commodities generally trade in US dollars. Note that the US dollar just went below parity versus the Euro. The downside will be lower corporate earnings for companies with overseas operations.

The Fed’s Beige Book reported that economic activity expanded at a “modest” pace (“modest” is Fed-speak for “meh”), but several districts reported that they are seeing a decrease in demand and many noted an increased risk for a recession.

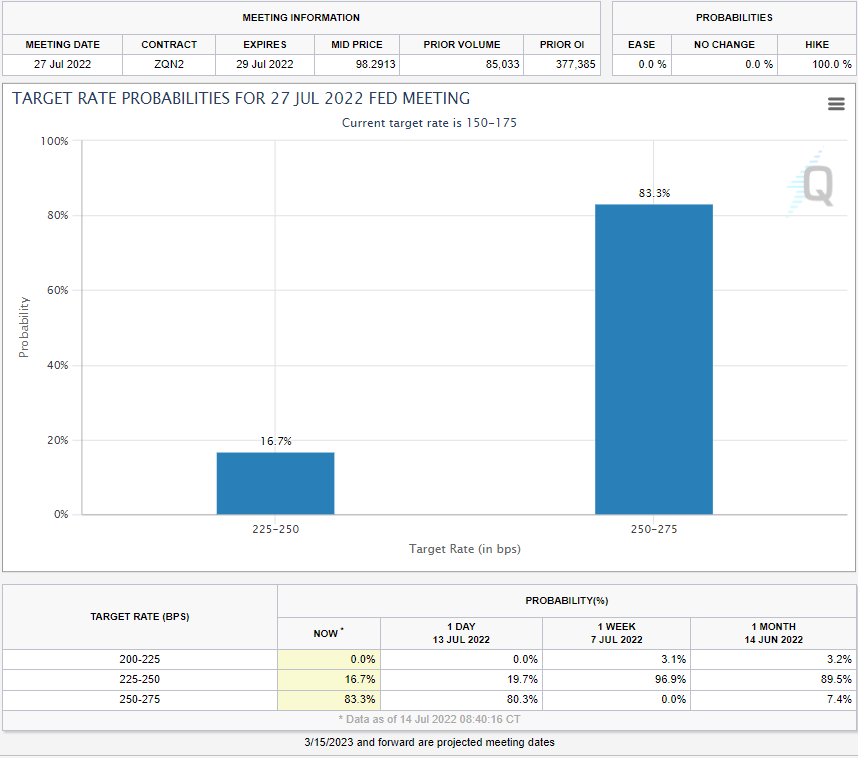

The increase in the CPI and PPI has changed the outlook for the July FOMC meeting. The markets are now predicting a 83% chance for a 100 basis point hike in the Fed Funds rate. For the end of the year, the central tendency is a rate of 3.75% – 4%, which would indicate another 125 basis points of increases in September, October and December.

The fact that we are talking about recessionary conditions now, with this much tightening ahead of us and a 9 – 12 month lag for the economic effects to matter bodes ill for the economy by the end of the year and into 2023.

The spread between the 2 year and the 10 year bond has become even more negative, falling to -23 basis points. This recessionary indicator is flashing red.