[ad_1]

BQ Prime’s special research section collates quality and in-depth equity and economy research reports from across India’s top brokerages, asset managers and research agencies. These reports offer BQ Prime’s subscribers an opportunity to expand their understanding of companies, sectors and the economy.

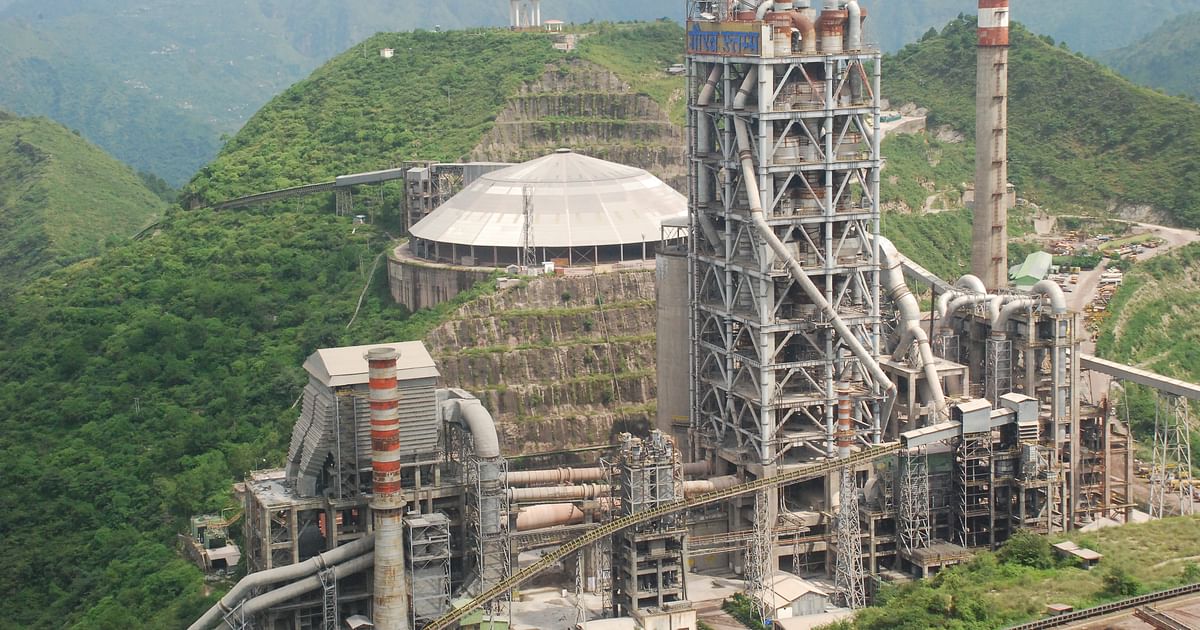

UltraTech Cement Ltd. reported revenue, volume in line, however realization, Ebitda, Ebitda/tonne and adjusted profit after tax above estimates.

UltraTech Cement posted up 28.2% YoY growth in revenue to Rs 151.6 billion led by up 16.3% YoY in volume to 25.0 million tonne (down 9.6% QoQ) coupled with up 10.2% YoY in realisation/tonne (up 6.4% QoQ) to Rs 6,025.

Ebitda/adjusted profit after tax down 6.4%/ 7.0% YoY to Rs 30.9 billion/ Rs 15.8 billion due to higher opex.

UltraTech Cement’s capacity to increase from 120 million tones per annum (FY22) to 136.7 mtpa/ 159.3 mtpa in FY23/ FY25-26.

It also announced further expansion to 200 mtpa by FY30 to support future growth. It will continue to witness healthy operating cash flow and free cash flow leading to further deleveraging.

Click on the attachment to read the full report:

DISCLAIMER

This report is authored by an external party. BQ Prime does not vouch for the accuracy of its contents nor is responsible for them in any way. The contents of this section do not constitute investment advice. For that you must always consult an expert based on your individual needs. The views expressed in the report are that of the author entity and do not represent the views of BQ Prime.

Users have no license to copy, modify, or distribute the content without permission of the Original Owner.

[ad_2]

Image and article originally from www.bqprime.com. Read the original article here.