[ad_1]

- During the Asian trading session, the euro retreated from 0.99800 to 0.99500.

- During the Asian trading session, the pound retreated to the 1.17750 level.

- Consumer confidence in Germany fell further to a record low in September.

EURUSD chart analysis

During the Asian trading session, the euro retreated from 0.99800 to 0.99500, where it found support and started a new bullish impulse. Now the euro is at 1.00000 and will try to hold on to that level once again to continue the recovery. For a bullish option, we need a continuation of positive consolidation. The pair could then climb up to the 1.00500 level. Additional resistance at that point is in the MA200 moving average. A potential higher target is the 1.01000 level. We need a negative consolidation and a euro return below the 1.01000 level for a bearish option. After that, the pair could continue to retreat. Our potential support is MA20 and MA50 in the zone around 0.99800 levels. A break below would increase bearish pressure. Potential lower targets are 0.99500 and 0.99000 levels.

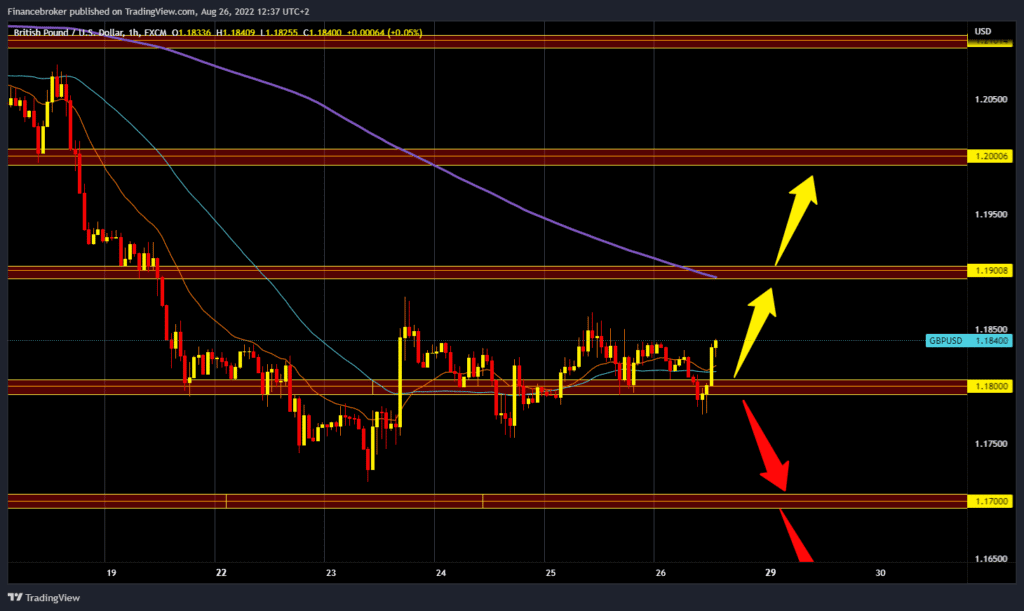

GBPUSD chart analysis

During the Asian trading session, the pound retreated to the 1.17750 level, which was followed by a bullish impulse and a move above the 1.18000 level. We are now at the 1.18360 level, and we can expect the pound to continue this recovery until the end of the day.

We need a continuation of today’s positive consolidation and a break above the 1.18500 level for a bullish option. We have support in the MA20 and MA50 moving averages, and based on them, we could hope for a recovery to the 1.19000 level. Additional resistance at that level is in the MA200 moving average. The potential targets above are the 1.19500 and 1.20000 levels. We need a negative consolidation and a pound fall to the 1.18000 level for a bearish option. A break below the pound would increase negative pressure, and the pair could continue to fall. Potential lower targets are 1.17500 and 1.17000 levels.

Market Overview

Consumer confidence in Germany fell further to a record low in September. The forward-looking consumer sentiment index fell to -36.5 in September from -30.9 in August. The fear of high energy costs in the coming months is forcing many households to take precautions and save money for upcoming energy bills, said Rolf Burkl, consumer expert at GfK. We can expect a deterioration in the coming weeks and months if the supply of fuels is insufficient to meet the demand during the coming winter.

BONUS VIDEO: Weekly news summary from the markets

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.