[ad_1]

- Pair EURUSD at the beginning of the new week fell below the 0.99000 level.

- This morning, the pound fell to a new two-year low at the 1.14500 level.

- The eurozone private sector fell for the second month in a row.

EURUSD chart analysis

Pair EURUSD at the beginning of the new week fell below the 0.99000 level, forming a new twenty-year low. Today’s low was at the 0.98770 level. After that, the euro began to recover and returned above the 0.99000 level. Now we are at the 0.99350 level, and soon we will be at the 0.99500 level and thus close the gap that happened at the opening of the Asian market. If the euro approaches and perhaps tests the 1.00000 level, it would be considered very positive in addition to this morning’s decline. For a bullish option, we need the continuation of the current positive consolidation and the growth of the euro to the 1.00000 level. Then we must climb above and try to maintain that level to continue on the bullish side. Potential higher targets are 1.00500 and 1.01000 levels. For a bearish option, we need a new withdrawal of the euro below the 0.99000 level and a new pressure on this morning’s low. If we were to visit that level again, we would have a chance to continue even lower. Potential lower targets are 0.98500 and 0.98000 levels.

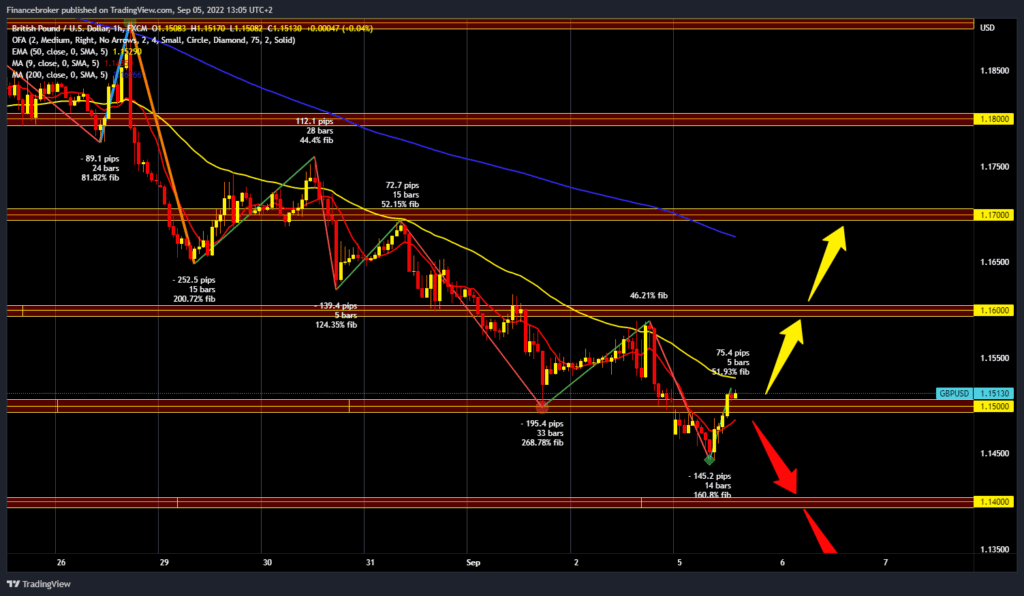

GBPUSD chart analysis

This morning, the pound fell to a new two-year low at the 1.14500 level. A recovery to the 1.15000 level soon followed, and we are now maintaining at that level. We notice that we have resistance in the MA50 moving average, which has been resistance for us for five days, and we manage to stay below it. For a bullish option, we need a continuation of the current positive consolidation and a continuation to the 1.15500 level. If we were to hold on to that position, the continuation would be certain up to the 1.16000 level. We need a new negative consolidation and a return below the 1.15000 level for a bearish option. After that, the pound should revisit the low at the 1.14500 level. A potential lower target is the 1.14000 level.

Market Overview

The eurozone private sector fell for the second month in a row. The services sector joined manufacturing in recording a decline in output in August, final data from S&P Global showed this morning.

The composite manufacturing index fell to an 18-month low of 48.9 in August from 49.9 in July. Although the overall rate of decline in the private sector remained only moderate, in line with GDP falling at a quarterly rate of just 0.1 %, the latest data indicates that the economy is at its weakest in nine years, excluding the declines recorded during the covid pandemic.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.