Vital Statistics:

| Last | Change | |

| S&P futures | 3,948 | 3.15 |

| Oil (WTI) | 102.44 | 1.95 |

| 10 year government bond yield | 2.97% | |

| 30 year fixed rate mortgage | 5.78% |

Stocks are flattish this morning as earnings continue to come in. Bonds and MBS are up.

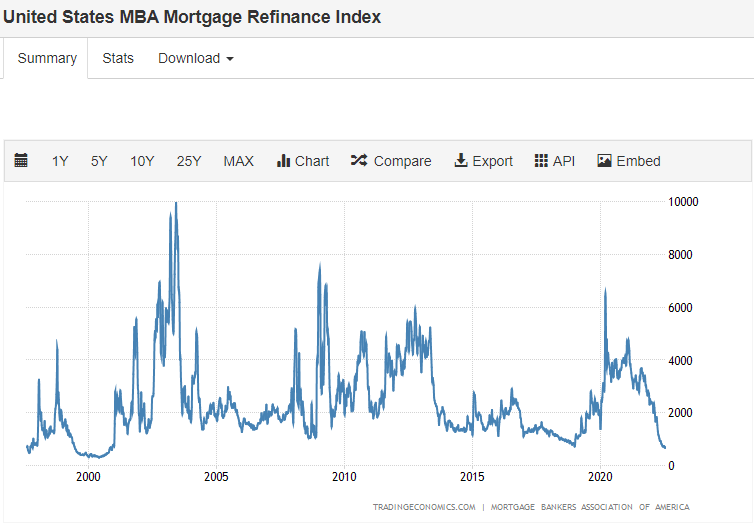

Mortgage applications fell 6.3% last week as purchases fell 7% and refis fell 4%. “Mortgage applications declined for the third week in a row, reaching the lowest level since 2000. Similarly, with most mortgage rates more than two percentage points higher than a year ago, demand for refinances continues to plummet, with MBA’s refinance index also falling to a 22-year low,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity declined for both conventional and government loans, as the weakening economic outlook, high inflation, and persistent affordability challenges are impacting buyer demand. The decline in recent purchase applications aligns with slower homebuilding activity due to reduced buyer traffic and ongoing building material shortages and higher costs.”

You can see the chart below of the MBA refinance index hitting lows last seen around 2000.

Existing Home Sales fell 5.4% in June, according to the National Association of Realtors. This is the fifth decline in a row. Sales fell 14.2% YOY to a seasonally adjusted annual rate of 5.1 million. “Falling housing affordability continues to take a toll on potential home buyers,” said NAR Chief Economist Lawrence Yun. “Both mortgage rates and home prices have risen too sharply in a short span of time.”

The median home price rose 13.4% to $416,000. Days on market hit a record low of 14 days. “Finally, there are more homes on the market,” Yun added. “Interestingly though, the record-low pace of days on market implies a fuzzier picture on home prices. Homes priced right are selling very quickly, but homes priced too high are deterring prospective buyers.”