[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,103 | -17.25 |

| Oil (WTI) | 94.53 | -4.80 |

| 10 year government bond yield | 2.59% | |

| 30 year fixed rate mortgage | 5.26% |

Stocks are lower this morning on no real news. Bonds and MBS are down.

Job openings fell by 600k in June, according to the JOLTS jobs report. Most of the decrease came in retail, as consumers are beginning to curtail their spending due to rising prices for necessities. The quits rate (which tends to lead wage inflation) remained at 2.8%. Overall, this report shows that the labor market is beginning to cool off.

Home prices continued to appreciate in July, according to the Clear Capital Home Data Index. The usual suspects – Raleigh, Miami, Tampa were the leaders again, but some of the laggards are beginning to heat up. Topping the list with nearly 11% QOQ growth was Rochester, New York. A couple other MSAs – Milwaukee WI and Hartford CT made the list of top 15 MSAs. Interestingly, some of the slowest appreciating MSAs were the ones that led the rally – San Jose, San Francisco, Seattle etc.

I wonder if work-from-home will cause some of these MSAs to equalize. As inflation continues to sap disposable income, perhaps people will relocate to cheaper places

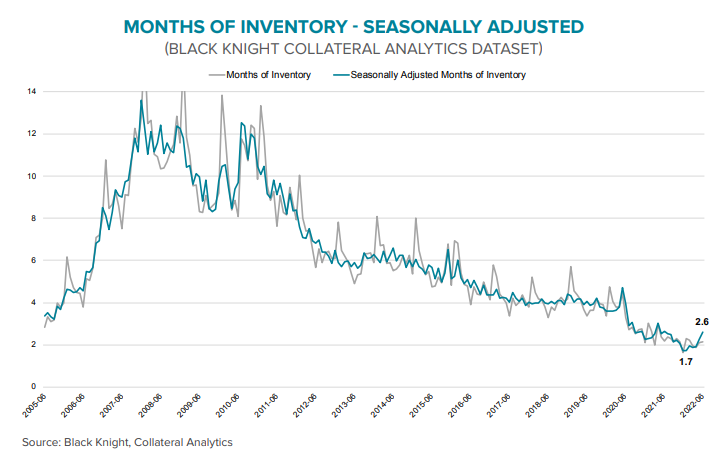

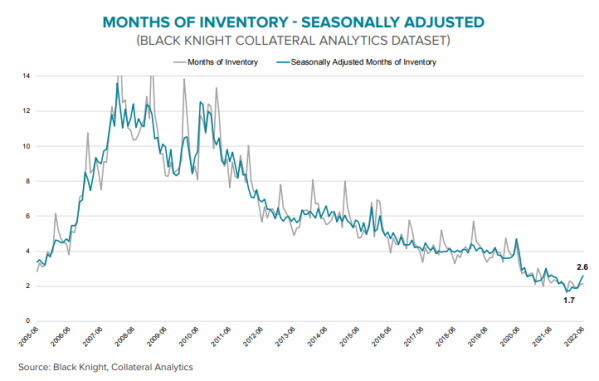

One of the big drivers of home price appreciation has been a lack of homes for sale. Inventories are down some 54% from the average of 2017-2019, according to Black Knight. That said, it looks like inventory is beginning to increase again, as the number of homes for sale rose by 114k over the past two months. It would take a year of similar gains to get back to pre-pandemic normalcy. That said, we are still a long way from a balanced market. The US has underbuilt since the crisis, and is now stymied by shortages of labor and materials.

A balanced market is about 6 to 7 months’ worth of inventory. You can see how this metric has trended since the bubble days.

Inflation is beginning to negatively affect the finances of younger, lower-income Americans, which is causing them to build balances on their credit cards. Delinquencies have yet to take off, but non-mortgage debt is increasing.

For consumers with a mortgage, rising home prices has meant that they are increasing home equity. Debt consolidation cash-out refinances can be an attractive way to lower the monthly payment for people with lots of credit card debt.

Rocket is getting into home equity loans. The company will offer fixed rate home equity loans for a 10 or 20 year terms up to a 90 LTV. Rocket isn’t the only one getting into this line of business: New Residential, Guaranteed Rate and Loan Depot are as well.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.