[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,251 | -29.50 |

| Oil (WTI) | 87.46 | -4.67 |

| 10 year government bond yield | 2.79 | |

| 30 year fixed rate mortgage | 5.42% |

Stocks are lower this morning on weak Chinese data. Bonds and MBS are up small.

The upcoming week won’t have much in the way of market-moving data, however we will get some housing data with the NAHB Housing Market Index today, housing starts on Tuesday, and existing home sales on Thursday. We will also get the FOMC minutes on Wednesday.

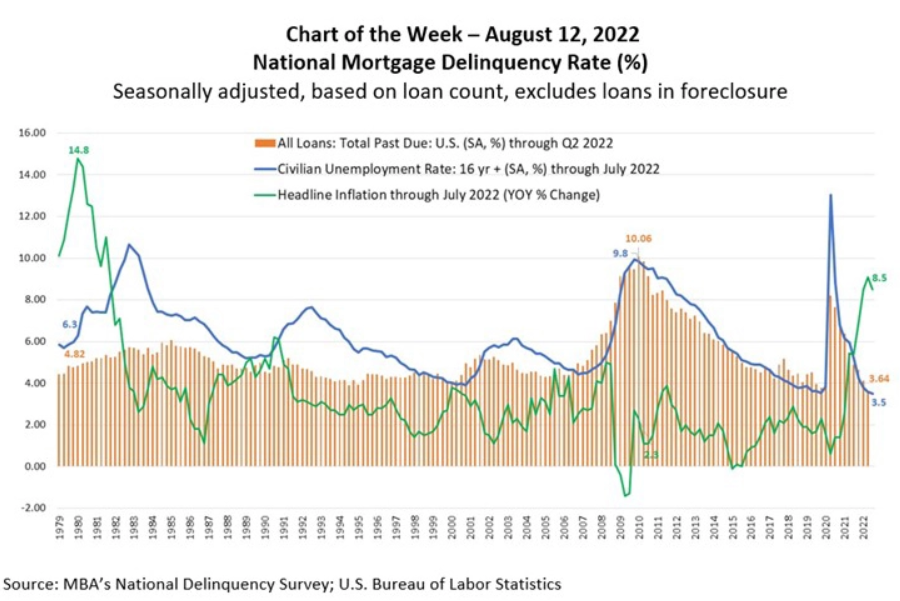

Mortgage delinquency rates were 3.64% in the second quarter, which is a series low dating back to 1979. The delinquency rate and the unemployment rate track super-closely, as you can see from the chart below.

Wells Fargo is looking to shrink its mortgage footprint and cut costs. It looks like correspondent lending will take a hit and the bank will probably focus on its own retail origination. The other area is Ginnie Mae servicing. Wells has pulled back from FHA lending and is looking to get out of FHA servicing as well. Ginnie Mae servicing requirements are much harsher than Fannie Mae or Freddie Mac servicing requirements.

“We’re not interested in being extraordinarily large in the mortgage business just for the sake of being in the mortgage business,” Scharf, 57, told analysts on a conference call last month. “We are in the home-lending business because we think home lending is an important product for us to talk to our customers about, and that will ultimately dictate the appropriate size of it.”

Theoretically all of these players exiting / downsizing their presence in the mortgage market should be good news for margins going forward, however both Rocket and United Wholesale guided for compressed margins in Q3. UWM said that margins would fall from 99 bps in Q2 to 30 – 60 in Q3.

Homebuilder confidence fell for the 8th straight month, according to the NAHB Housing Market Index. Sentiment is overall negative for the first time in a while. “Ongoing growth in construction costs and high mortgage rates continue to weaken market sentiment for single-family home builders,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “And in a troubling sign that consumers are now sitting on the sidelines due to higher housing costs, the August buyer traffic number in our builder survey was 32, the lowest level since April 2014 with the exception of the spring of 2020 when the pandemic first hit.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.