Vital Statistics:

| Last | Change | |

| S&P futures | 4,291 | -9.50 |

| Oil (WTI) | 88.86 | -0.67 |

| 10 year government bond yield | 2.83 | |

| 30 year fixed rate mortgage | 5.37% |

Stocks are lower this morning on fears of a hard landing. Bonds and MBS are down small.

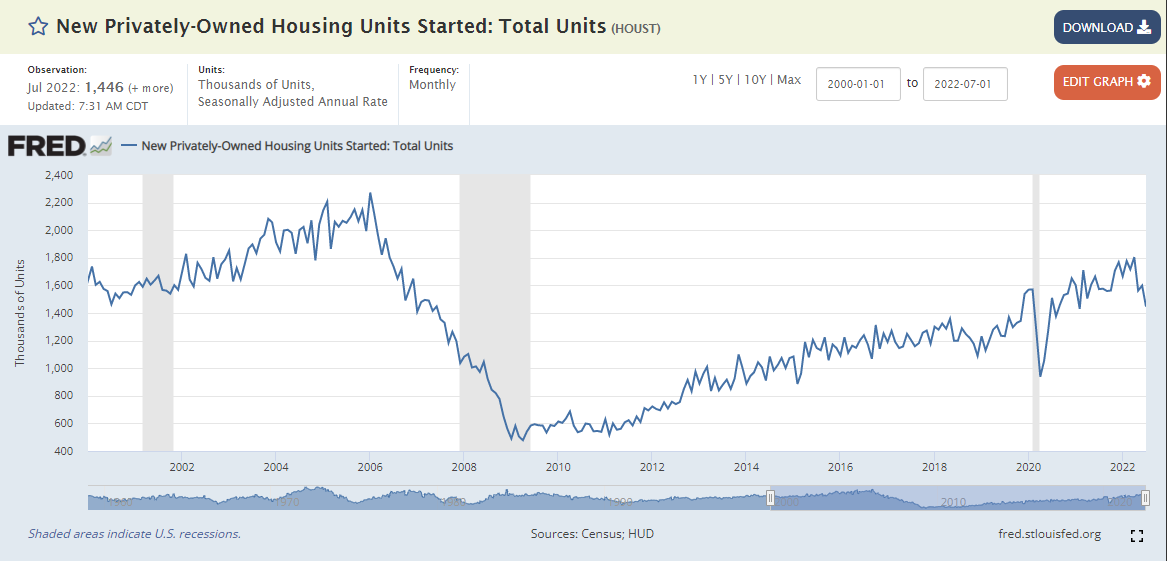

Housing starts fell 9.6% MOM to a seasonally-adjusted annual rate of 1.44 million. This was down 8.1% on a YOY basis. Building Permits were roughly flat at 1.67 million. The starts number was well below consensus.

Housing construction is dealing with a double-whammy of rising costs and declining affordability. Housing starts are still below where they were at the turn of the century, yet the US population has increased about 18% since then.

Housing Wire has another article on Wells and their downsizing. It speculates that Wells could shutter its correspondent business, but doesn’t provide much to go on. Like Chase it sounds like Wells really wants to de-emphasize FHA. That is interesting because the government generally wants banks to service FHA loans, not independent mortgage banks.

Industrial Production rebounded in July, according to the Fed. Production rose 0.6% MOM and 3.9% YOY. Capacity Utilization rose to 80.3%. Manufacturing production rose 0.7%. So far we aren’t seeing any evidence that the Fed’s rate hikes are slowing the manufacturing economy, at least not yet.

Non-QM lender Impac has slashed its workforce by 50% since the beginning of the year. The sharp and unexpected decline in net gain on sale of loans, the company said, “reflects the intense pressure on mortgage originations due to the dramatic collapse of the mortgage refinance market and the weakening mortgage purchase market, which has suffered from a lack of housing inventory and significant increase in mortgage interest rates resulting in customer affordability issues.”