[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,161 | 5.25 |

| Oil (WTI) | 90.93 | -0.20 |

| 10 year government bond yield | 2.69% | |

| 30 year fixed rate mortgage | 5.45% |

Stocks are higher this morning after yesterday’s rally. Bonds and MBS are up.

US employers announced 25,810 job cuts in July, according to outplacement firm Challenger, Gray and Christmas. This is down 21% from June but up about 36% compared to a year ago. For the first 7 months of the year, companies announced about 159,000 job cut which is a series low going back to 1993.

Automakers, retailers and financial firms were the biggest sectors announcing layoffs. “The job market remains tight, and large-scale layoffs have not begun. There are some indicators that hiring is slowing after months of growth, however,” said Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. “Job cut levels are nowhere near where they were in the 2001 and 2008 recessions right now, though they may be ticking up. If we’re in a recession, we have yet to feel it in the labor market,” said Challenger.

Separately, initial jobless claims continue to tick up. There were 260k initial claims last week, an increase from 254k the week before.

PennyMac Financial services reported that volumes fell 20% QOQ and 56% YOY to $26.7 billion. Like most originators out there, servicing income is making up for lost origination income. This shows the benefit of retaining servicing as a hedge for the origination business.

That said, with rates seeming to level out here, and a plethora of mortgage banks looking to sell servicing portfolios to increase liquidity, I suspect we might be at peak valuations for mortgage servicing rights. Delinquencies are low, but will almost certainly increase if the job market deteriorates.

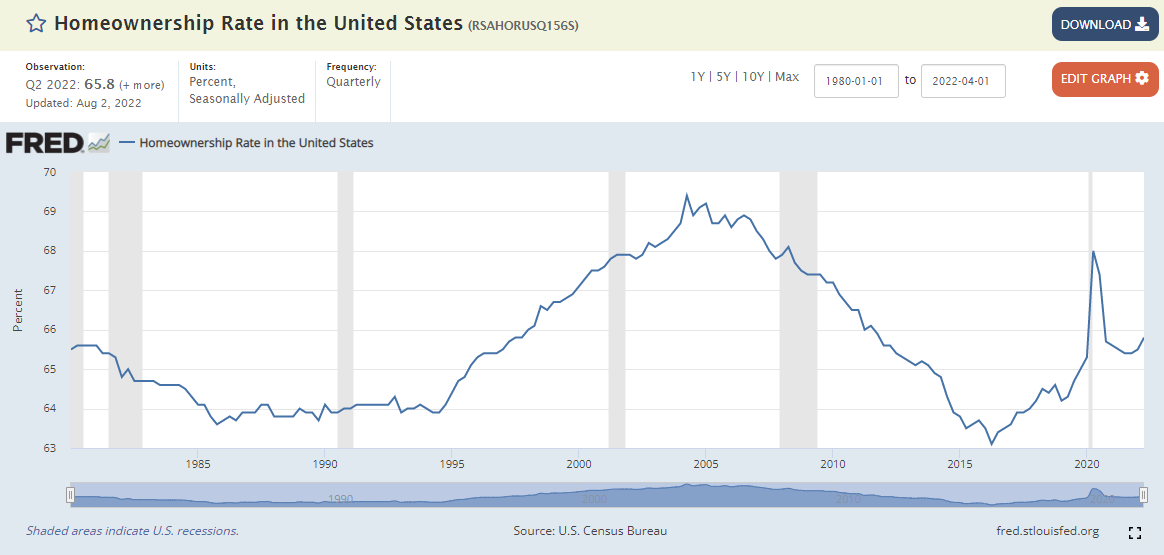

The US Homeownership rate ticked up from 65.4% in the first quarter to 65.8% in the second quarter, according to the Census Bureau. The rental vacancy rate ticked down from 5.8% to 5.6%.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.