[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,044 | 15.00 |

| Oil (WTI) | 94.07 | -1.38 |

| 10 year government bond yield | 3.09% | |

| 30 year fixed rate mortgage | 5.79% |

Stocks are higher this morning on no real news. Bonds and MBS are up small.

Minneapolis Fed President Neel Kashkari said he was “happy” to see the stock market reaction to Jerome Powell’s speech on Friday. “I was actually happy to see how Chair Powell’s Jackson Hole speech was received,” Kashkari said in an interview with Bloomberg’s Odd Lots podcast on Monday, reflecting on the steep drop after Powell spoke. “People now understand the seriousness of our commitment to getting inflation back down to 2%.”

Since Neel Kashkari has historically been one of the biggest doves on the Fed, this statement has even more impact. The market is interpreting Powell’s remarks as the Fed wants to see demand destruction, not just an improvement on the supply side. In other words, falling commodity prices and an improvement in supply chain issues are a necessary, but not sufficient, impetus to get the Fed to pivot. IMO, the Fed wants to see at least 4% unemployment before it thinks of pulling back.

We are seeing some improvements on the inflation front. One indicator that is useful for global demand is the Baltic Dry Index which measures the cost of moving raw materials by sea. When the index falls, it indicates that demand is slowing. We can see the chart below which has been falling.

Fridays jobs report could be a reversion to the old “bad news is good news” phenomenon. If we see an uptick in unemployment, markets could rally since this would mean the Fed’s tightening is gaining traction.

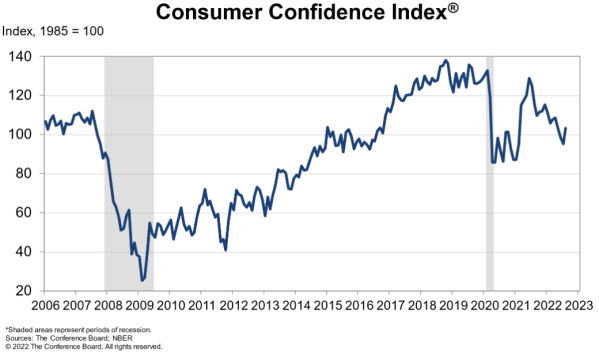

Consumer Confidence improved in August according to the Conference Board. These consumer confidence indices are heavily influenced by gasoline prices, so this does reflect an easing of prices over the past month.

“Consumer confidence increased in August after falling for three straight months,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index recorded a gain for the first time since March. The Expectations Index likewise improved from July’s 9-year low, but remains below a reading of 80, suggesting recession risks continue. Concerns about inflation continued their retreat but remained elevated. Meanwhile, purchasing intentions increased after a July pullback, and vacation intentions reached an 8-month high. Looking ahead, August’s improvement in confidence may help support spending, but inflation and additional rate hikes still pose risks to economic growth in the short term.”

Job openings ticked up slightly in July, but the trend is still generally lower as we retreat from record highs. The quits rate (which tends to lead wage growth) ticked down to 2.7%. This is an indication that the labor market is softening a touch. Note this is July data, so it is somewhat dated.

Home prices rose 17.7% YOY and 4% QOQ, according to the FHFA House Price Index. “Housing prices grew quickly through most of the second quarter of 2022, but a deceleration has appeared in the June monthly data” said William Doerner, Ph.D., Supervisory Economist in FHFA’s Division of Research and Statistics. “The pace of growth has subsided recently, which is consistent with other recent housing data.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.