[ad_1]

- The price of oil has increased by 3.38%, from $87.00 to $89.80, and we may soon test the $90.00 level.

- The price of natural gas today is around the $9.00 level.

- OPEC+ is likely to keep oil production quotas unchanged for October at a meeting today, five OPEC+ sources said.

Oil chart analysis

Since the beginning of the Asian trading session, the price of oil has increased by 3.38%, from $87.00 to $89.80, and we may soon test the $90.00 level. In the bird’s eye, the price tried to make a break above, but without success, and we saw a pullback to the $87.00 support level. For a bullish option, we need to break prices above, then try to hold above there. And after that, let’s continue with the positive consolidation up to the $92.00 resistance level. Additional resistance to that level is in the MA200 moving average. We need a negative consolidation and pullback towards the $88.00 support level for a bearish option. If we do not hold above, we will see a break below and another visit to the $86.00-87.00 support zone. Potential lower targets are $85.00 and $84.00 levels.

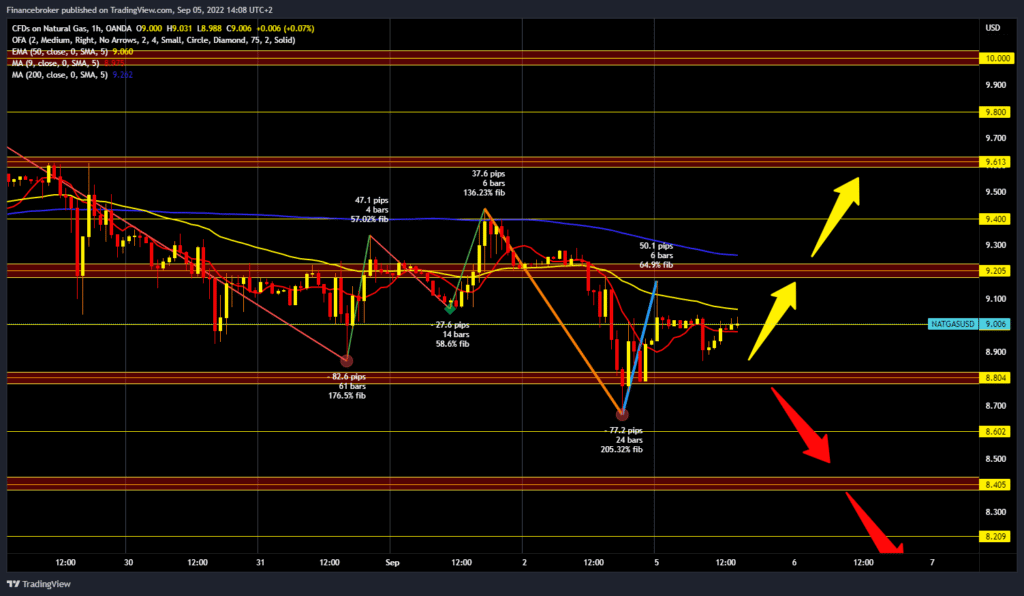

Natural gas chart analysis

The price of natural gas today is around the $9.00 level, although still on the bearish side because we saw the formation of a new lower low on Friday, and for now, we are unable to form a new higher high on the chart. To continue the bullish consolidation, we need a price jump to the $9.20 level. Additional resistance at that level is in the MA200 moving average. If we could manage to climb above, we would have a better chance of continuing the recovery. Potential higher targets are $9.40 and $9.60 levels. For a bearish option, we need a negative consolidation and a price drop to the $8.80 support level. If we fail to hold on to that level, we will see a break below and the possible formation of a new lower low. Potential lower targets are $8.60 and $8.40 levels.

Market Overview

OPEC+ is likely to keep oil production quotas unchanged for October at a meeting today, five OPEC+ sources said. However, some sources did not rule out small production cuts to support falling prices on fears of an economic downturn. Iran is expected to increase output by 1 million barrels a day or 1% of global demand if sanctions are eased, although the prospect of a nuclear deal looked less likely on Friday.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.