[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,187 | -44.50 |

| Oil (WTI) | 91.20 | -0.67 |

| 10 year government bond yield | 2.98% | |

| 30 year fixed rate mortgage | 5.60% |

Stocks are lower this morning as last week’s selling continues. Bonds and MBS are flat.

The upcoming week will have some important economic data with the second revision to Q2 GDP on Thursday, and personal incomes / spending on Friday. The personal income and spending indices will contain the personal consumption expenditures inflation index which is the Fed’s preferred measure of inflation.

The Jackson Hole summit will also take place this week. Jerome Powell will speak on Friday. There usually isn’t much in the way of market-moving data during these events, but the markets are hyper-attuned to the potential for a Fed pivot.

Investors hoping for the Fed Pivot were left disappointed by the minutes from the July meeting. “Participants agreed that there was little evidence to date that

inflation pressures were subsiding. They judged that inflation would respond to monetary policy tightening and the associated moderation in economic activity with a delay and would likely stay uncomfortably high for some time.”

While some participants thought the Fed Funds rate had hit the “neutral” range, others pointed out that with inflation so high, real interest rates were still stimulative. Some said that the Fed Funds rate needed to get to a restrictive level.

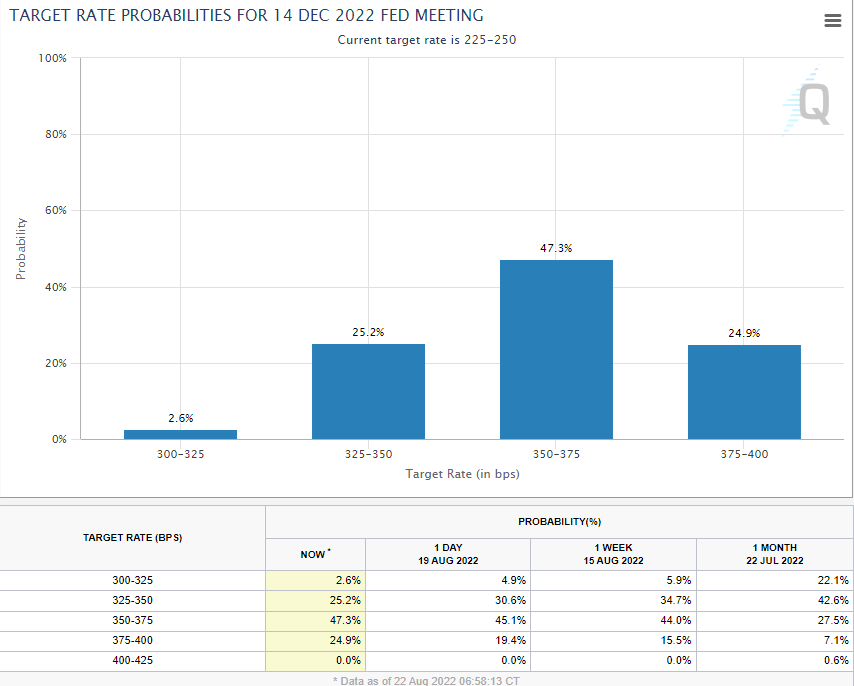

Bottom line: the rate hikes will continue. The Fed Funds futures became slightly more hawkish after the minutes, with the market now looking at 125 basis points in tightening by the end of the year.

Existing home sales fell for the sixth month in a row, according to NAR. The median home price fell about $10,000, although it is up 10.8% on a year-over-year basis. “The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June,” said NAR Chief Economist Lawrence Yun. “Home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers…”We’re witnessing a housing recession in terms of declining home sales and home building,” Yun added. “However, it’s not a recession in home prices. Inventory remains tight and prices continue to rise nationally with nearly 40% of homes still commanding the full list price.”

Some MSAs have been pretty hot, especially in Florida and Phoenix. I wouldn’t be surprised to see prices begin to peak in these areas, but the chance for a nationwide decline in prices seems remote. We just don’t have enough supply, and I suspect there are a lot of people who will enter the market on a pullback.

Economic Activity improved in July, according to the Chicago Fed National Activity Index. This is sort of a meta-index that takes into account all sorts of leading and lagging indicators. Production and incomes drove the increase, although all 4 indicators (production, employment, consumption and sales) increased.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.