[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,869 | 18.25 |

| Oil (WTI) | 99.31 | -4.74 |

| 10 year government bond yield | 2.91% | |

| 30 year fixed rate mortgage | 5.81% |

Stocks are up this morning as oil prices fall. Bonds and MBS are up.

Small Business Optimism declined again, according to the National Federation of Independent Businesses. “As inflation continues to dominate business decisions, small business owners’ expectations for better business conditions have reached a new low,” said NFIB Chief Economist Bill Dunkelberg. “On top of the immediate challenges facing small business owners including inflation and worker shortages, the outlook for economic policy is not encouraging either as policy talks have shifted to tax increases and more regulations.”

The report is interesting in that it captures the divergence in the economy right now. If you look at things like sales, profits and economic sentiment, the situation is pretty negative. If you look at the employment picture, it is the exact opposite.

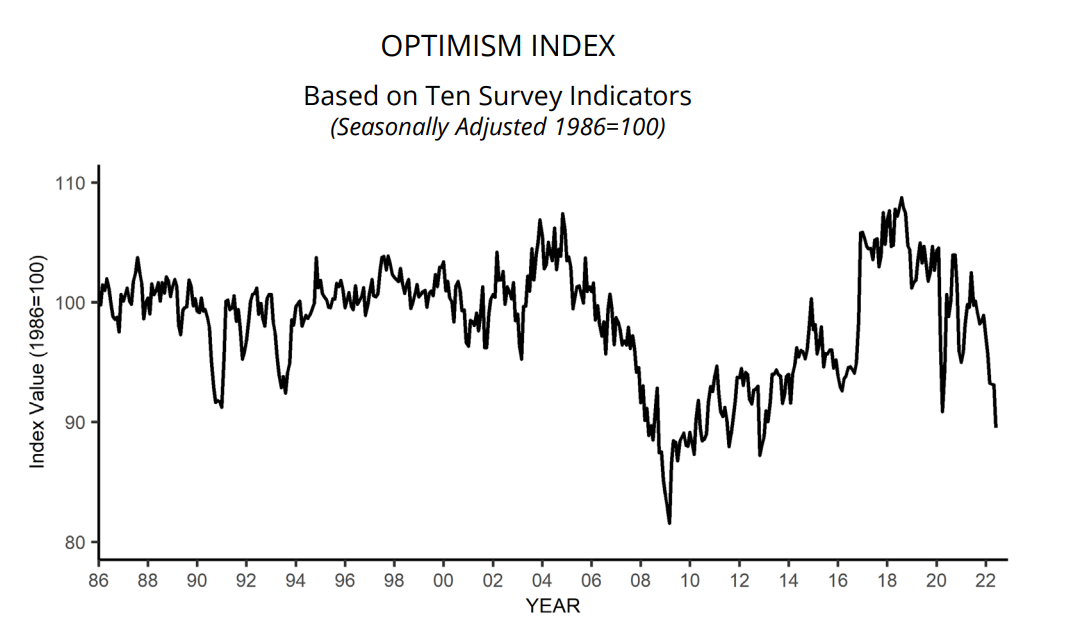

That said, the chart for economic optimism is getting pretty dire and approaching Great Recession levels.

The Atlanta Fed GDP Now Index has improved somewhat, but we are looking at negative growth still with the index showing a -1.2% estimate. This would make two consecutive quarters of negative GDP growth, however the media / government is pushing back against calling this a recession. Ultimately, the official recession call is ultimately subjective and the administration / media will be working the refs pretty hard.

Loan Depot is doing a massive restructuring to get its costs in line. Headcount is going to decline 43% between the end of 2021 and 2022. Their outlook is quite dire. We are executing our Vision 2025 plan on a foundation of a strong balance sheet and ample liquidity, with a current cash position of approximately $1 billion. We anticipate continued challenging market conditions, with mortgage originations projected to decline by roughly half in 2022 from 2021, including an accelerated decline in the second half of 2022, followed by a further decline in 2023. We continued to reduce our costs significantly in the second quarter. Over the next two quarters, we expect to accelerate these efforts and aggressively drive down our costs in line with our previously stated goal of exiting this year with a profitable operating run rate. After two years of substantial headcount and expense growth that was necessary to support unprecedented origination volumes we are returning to previous levels of staffing and expense.”

Loan Depot stock has been a disaster this year, falling 70% year-to-date. The current dividend of $0.08 a share clearly ain’t happening – that 19% yield is not real. Surprised they didn’t just rip the band aid off and cut the dividend to $0.02 a quarter.

Mortgage credit availability fell in June, according to the MBA. “Mortgage credit availability decreased slightly in June, as significantly higher mortgage rates compared to a year ago slowed refinance activity and impacted the overall mortgage credit landscape,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “While there was reduced supply of lower credit score, high LTV rate-term refinance programs, the decline was offset by increased offerings for conventional ARM and high balance loans. With higher rates and elevated home prices, more prospective buyers are applying for ARMs, but activity remains below historical averages.”

I am guessing this doesn’t take into account the NQM market, which will be affected by the exit of Sprout and FGMC. Mortgage credit is getting close to the levels seen in the aftermath of the Great Recession.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.