[ad_1]

Great start, Greater Ambitions

“I think it’s very important to have a feedback loop, where you’re constantly thinking about what you’ve done and how you could be doing it better.”

– Elon Musk

Its that time of the year, we pause and reflect on the year gone by. The key events are relooked and re-examined. The decisions made , the underlying assumptions and the eventual outcomes are studied with the added benefit of “hindsight”.

The objective is simple: Continue to do what was done right, avoid repeating the same mistakes again and most importantly work on things which can be made better.

As they say, “Feedback is the breakfast of champions”

Performance Review 2021

Acceler8 is Tactical portfolio based on Momentum investing strategy for accelerated wealth creation over a short horizon of 1 week to 1 year. The acceler8 portfolio service was launched on 17th Feb 2021.

You can read more about the proprietary Bluechip momentum strategy here:

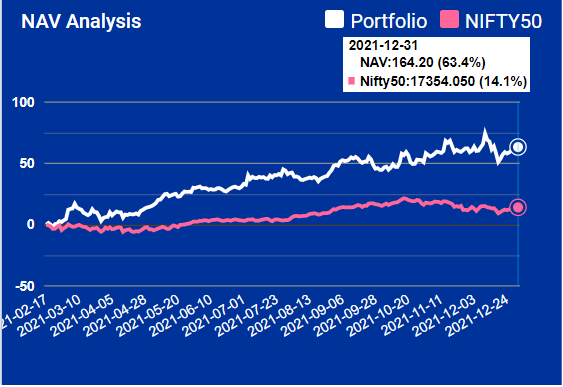

Few Data points on Performance between 17th Feb 2021 – 31st Dec 2021

1. NAV +63.4% @ 164.20

Rs 100 invested in the portfolio on inception would have grown to 164.20. This translates to 63.4% growth against a 14.1% growth of NIFTY 50 – an outperformance of +49.3% over benchmark NIFTY 50.

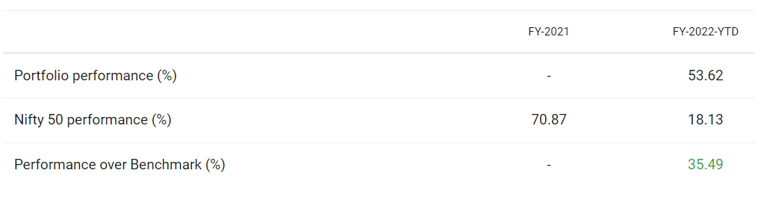

2. FY22 Performance @ +53.62%

acceler8 portfolio has consistently outperformed the benchmarks over 3 months, 6 months, and Year till Date time horizons.

1 Month: 0.72%

3 Months: 12.90%

6 Months: 24.73%

It has outperformed the benchmark Nifty 50 by 35.49%.

3. 21 out of 21 trades closed with +25% returns

We have done 25 trades since inception. We have closed 21 positions with 4 open positions. We have closed 21 consecutive trades with a profit of +25% returns and an XIRR of 113.76%.

Closed positions (ALL)

Please find below the list of closed positions with the latest on top.

In this quarter, we closed 4 positions with our Mahurat trade giving us a fabulous return (CAGR 931.66%) in just two weeks.

Way Ahead

Overall, I am very happy with how the portfolio has performed till date. I am my own fiercest critic, and I can safely say that while +63% annualized ROI is good there are a few things we can do better.

After careful consideration of the data and also based on the many conversations with you all, there are a few things I must place before you all on what I believe is the best way forward

1. We have done 25 trades in 10 months or roughly 2 trades a month. I would love to see this average go up to 3 trades a month or 35 to 40 trades next year. Of course, it goes without saying, we will not trade for the sake of doing a trade.

2. While 21 consecutive trades of +25% is something to be proud of. Waiting to close every trade at +25% may not be a good idea.

There were instances last year where closing quickly and at reduced profit was a better option as waiting for the next wave of momentum to push up the scrip meant blocking of capital for an extended period for a few positions.

I know this is being over critical but then only when you hold yourself against high standards one can even think of being a success. In plain words, the duration of the trades may be shorter and we will not wait for +20% returns.

3. The markets were up +20% in the past calendar year with the Sensex scaling 62000 on Oct 19, 2021. While there are no two opinions that the markets were overheated last year and continues to do so.

The bull frenzy which propelled it to new highs regularly has again made few of us throw caution to the wind. The continuous new highs the markets were touching were really not in sync with the state of the underlying economy battered by COVID.

With my two decades in the market, I can safely say that euphoria and over-confidence are the early warning signs that you should double your vigil and that is what we do at acceler8.

With a solid start behind us, we will be flexing the muscles, taking a bit more risks and cash levels will be carefully monitored.

4. Lastly and most importantly, while the theme of earnings + learnings for the weekly acceler8 Follow my Portfolio service resonated with many of my subscribers, based on specific inputs from you all, we will be focusing more on acceler8 trades.

We will be doing more trades and also try to learn from the trades.

The Section A which focused on learning will no longer be tied to the newsletter. We will be continuing the weekly acceler8 Portfolio trade updates as usual.

Subscribe

Acceler8 service – A steal at current prices

To help more of you taste the magic of momentum, we have decided to offer a monthly plan starting today. The monthly charges are priced at Rs 800 per month. If you go annual, you get two months FREE and pay only for 10 months or 8000 per annum. Additionally, you get access to Stock and Ladder Telegram Channel which is currently worth 800 PA.

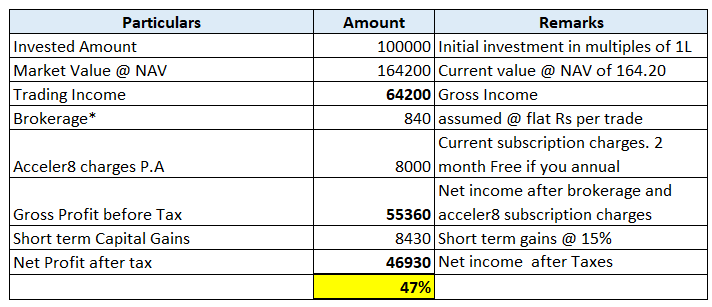

Your Indicative returns based on Past performance

Post taxes, brokerage and acceler8 subscription charges, you would have earned 47% returns.

Check out the calculations:

In case you have not yet subscribed to this service then do give it a serious consideration.

If you are a part-time investor, a non-investment professional keen on creating a second income or looking for ideas to make money working from home then you have come to the right place- Subscribe and add a bit of momentum magic to your portfolio.

You can pay by Credit card, UPI, Net Banking or QR code.

A) Credit Card

B) QR Code , UPI ID or Net Banking ( only annual plan)

Any feedback / suggestions , please drop a mail to superinvestorclub@gmail.com

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf

Let’s stay connected, Follow me on Twitter @Stocknladdr

[ad_2]

Image and article originally from stockandladder.com. Read the original article here.