[ad_1]

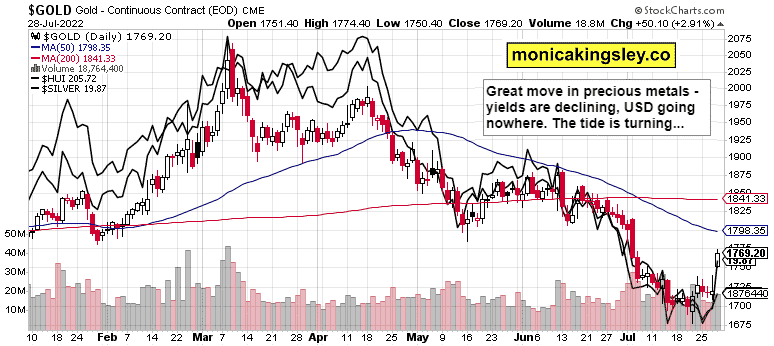

S&P 500 did a brief intraday downswing yesterday – very fast erased. Bonds strong, market breadth further improving, FOMO almost kicking in – and then AAPL and AMZN earnings interpretation provided for a fresh upleg aftermarket. Stock prices are to stall somewhat next, but not to roll over into a new downtrend – not yet. There is time, and early next week isn‘t yet flashing even just amber. Likewise the rally in precious metals is to continue, with miners still ridiculously inexpensive. Crude oil preparing for a new upleg in the $98 area while copper isn‘t giving up just below $3.50 either. Cryptos are signalling a weak entry to today‘s regular session, that‘s all – Monday is going to be a relatively good day across the board should today not turn out peachy (it won‘t be rosy, but won‘t be a disaster either).

Today, I’m again releasing (this time very brief) analytical synopsis customarily available for premium subscribers.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

S&P 500 and Nasdaq Outlook

S&P 500 is looking good – a bit of backing and filling next wouldn‘t hurt, and the medium-term uptrend remains intact. The reactions to latest earnings, guidance and Fed, had been optimistic, and I see no reason facilitating a sharp reversal early next week.

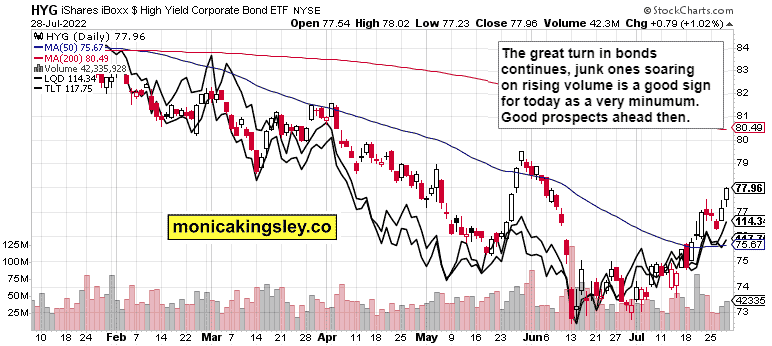

Credit Markets

HYG extended gains, quality debt instruments joined in, yet the risk-on turn is likely to get less pronounced today. It isn‘t over though, but bonds would facilitate a little consolidation in stocks next – one that didn‘t arrive yesterday, but appears knocking on the door timidly today.

Gold, Silver and Miners

Precious metals posture has significantly brightened up, and the months ahead are looking really good now. Inflation unpleasantly high, yields down, dollar barely up – this is a good constellation. Sensing a Fed pivot.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.