Vital Statistics:

| Last | Change | |

| S&P futures | 4,086 | 12.25 |

| Oil (WTI) | 100.01 | 3.88 |

| 10 year government bond yield | 2.71% | |

| 30 year fixed rate mortgage | 5.42% |

Stocks are up this morning after good numbers from Apple and Amazon. Bonds and MBS are down small.

Personal incomes rose 0.6% MOM in June, according to the BEA. This was a touch above expectations. Personal consumption expenditures increased markedly as well. This is generally good news for the economy.

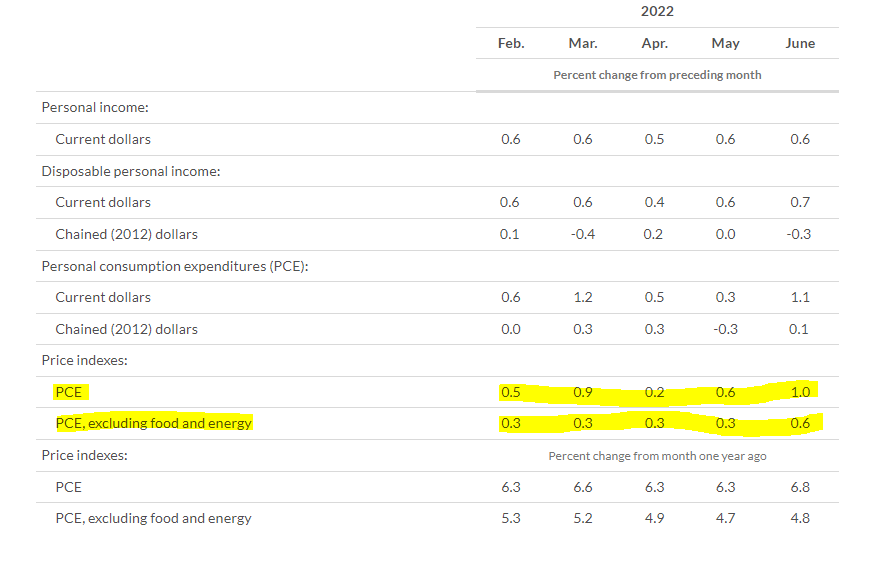

That said, the inflation numbers show no sign of decelerating. The highlighted numbers below are the month-over-month changes. If inflation is receding, the numbers should start falling from left to right. So far, that isn’t happening. On the bright side, the September meeting is a long way in the future, and the earlier hikes will begin have some impact.

Further bad news on the inflation front. The Employment Cost Index rose 1.3% in the second quarter and 5.1% YOY. Both numbers were above expectations. Wages rose 5.3% while benefit costs rose 4.8%. Ultimately the answer to rising wages is rising productivity, which hopefully will start rising as well.

Consumer confidence improved in the back half of July, according to the University of Michigan Consumer Sentiment Index. These consumer sentiment indices often reflect gasoline prices, so as gas prices fall, sentiment improves.